Table of Contents Show

The global push towards clean energy has reignited interest in nuclear power, and with it, a resurgence in uranium stocks. As we look ahead to 2024, several Canadian uranium companies are poised to capitalize on this growing demand. In this article, we’ll take a deep dive into the top Canadian uranium stocks that investors should keep on their radar.

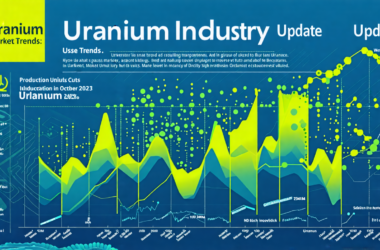

Rising Demand Fuels Uranium Market Growth

The increasing global demand for clean, reliable energy is a key driver for the uranium market. As countries seek to reduce their carbon footprint and transition away from fossil fuels, nuclear power has emerged as a viable alternative. This shift is expected to create a sustained demand for uranium, the primary fuel for nuclear reactors.

According to the World Nuclear Association, there are currently 444 operable nuclear reactors worldwide, with another 51 under construction. This growth in nuclear capacity is expected to drive uranium demand from 79,500 tonnes in 2021 to 100,224 tonnes by 2030. As a result, uranium prices are projected to rise, benefiting companies that can meet this growing need.

Cameco Corporation (TSX:CCO) Leads the Pack

Among the Canadian uranium companies, Cameco Corporation stands out as a top pick for investors. As one of the world’s largest uranium producers, Cameco boasts a diversified portfolio of assets across Canada, the United States, and Kazakhstan. The company’s flagship McArthur River and Cigar Lake mines are among the highest-grade uranium deposits globally, positioning Cameco to benefit from rising uranium prices.

Cameco’s strong balance sheet and long-term contracts with utilities provide a stable foundation for growth. The company’s management has demonstrated a disciplined approach to production, focusing on value over volume. This strategy has allowed Cameco to weather market downturns and emerge as a leaner, more efficient producer.

Comparing Cameco to its Competitors

While Cameco is a clear leader in the Canadian uranium space, it’s worth comparing the company to its competitors. NexGen Energy Ltd. (TSX:NXE) is an emerging player with a high-grade uranium deposit in Saskatchewan’s Athabasca Basin. NexGen’s Arrow deposit boasts a high-grade resource of 256.6 million pounds of U3O8, making it one of the world’s largest undeveloped uranium projects.

Another notable competitor is Denison Mines Corp. (TSX:DML), which owns a 90% interest in the Wheeler River project, also located in the Athabasca Basin. Denison’s Phoenix deposit is the highest-grade undeveloped uranium deposit in the world, with an average grade of 19.1% U3O8.

While these competitors have promising projects, Cameco’s established production, strong balance sheet, and experienced management team give it a competitive edge. Cameco’s ability to ramp up production quickly in response to market demand is a key advantage over its peers.

Investment Highlights for Cameco Corporation

For investors considering Cameco Corporation, several key features make the company an attractive investment opportunity:

- Established production: Cameco’s existing mines and proven track record of uranium production provide a solid foundation for future growth.

- High-grade reserves: The company’s McArthur River and Cigar Lake mines are among the highest-grade uranium deposits globally, enabling low-cost production.

- Long-term contracts: Cameco’s portfolio of long-term contracts with utilities provides revenue stability and visibility.

- Strong balance sheet: The company’s solid financial position allows it to weather market volatility and invest in growth opportunities.

- Experienced management: Cameco’s leadership team has a proven track record of navigating the uranium market and delivering value to shareholders.

As the global demand for clean energy continues to grow, Canadian uranium stocks are well-positioned to benefit. Among these companies, Cameco Corporation stands out as a top pick for investors seeking exposure to the uranium market. With its established production, high-grade reserves, and strong financial position, Cameco is poised to capitalize on the rising demand for uranium in the coming years.