When I interview financial advisors in Canada, a few consistent themes bubble to the surface when we discuss investments.

Things like ‘Canadians aren’t utilizing tax vehicles to maximize returns.’ And ‘Canadians need to put more in their TFSAs’. And of course, this one is on blast: ‘Don’t contribute to your RRSP at the last minute!’

Another theme is ‘holistic planning’, which came up during conversations with Janet Gray and Steve Bridge from Money Coaches Canada. Meaning, considering all areas of the client’s finances (investments, pensions, tax, insurance, long-term and short-term goals, etc.) brought together for one, thorough financial plan.

There are also ‘things to avoid’ that come up during these conversations. Here are the top three investment mistakes that are mentioned:

1. Not Investing Early Enough

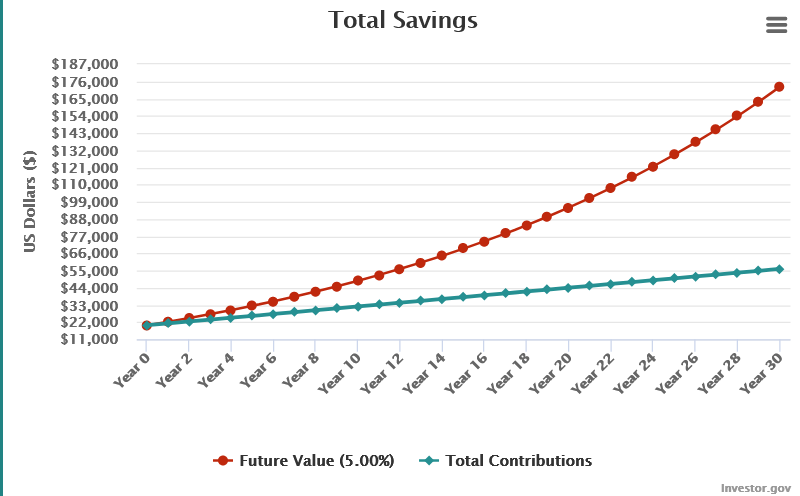

While we can’t use time machines, the second best time to invest is today. The power of compound interest will continue to prevail. And we can help educate those who may be younger than us with illustrations. For example, Ally, 27, and Garcia, 37, start their investment journey with $20,000 each, with the plan to withdraw the funds at the age of 57. They both invest $100 a month, which compounds monthly, at a 5% annual rate of return.

In 20 years – Garcia will have $95,356.17

In 30 years – Ally will have $172,580.75

That’s almost double, yet Ally only invested an additional $12,000 due to the 10-year difference. I find these results to be staggering and think it may be worth sharing these charts with younger relatives or clients to illustrate the power of compound interest. And the real value in starting to invest early. Time is money and it’s truly the greatest tool we have in building wealth.

2. Getting in Our Own Way (aka Behaviour)

Impulse purchases can lead to poorly timed purchases. In the most recent Morningstar Mind the Gap study, we learn that that can cost us a fifth of our returns.

Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 6% per year on the average dollar they invested in mutual funds and exchange-traded funds over the trailing 10 years ended Dec. 31, 2022. This is about 1.7 percentage points less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from poorly timed purchases and sales of fund shares, which cost investors roughly one-fifth the return they would have earned if they had simply bought and held.

This pattern is consistent year-over-year in these studies. Investors fared the worst in sector equity funds, giving up more than 4 percentage points per year because of poorly timed fund flows.

This is another sigh-inducing case of investors chasing returns. Trying to buy low and sell high – but it isn’t working. The magic happens in the most boring way… when you buy and hold. It isn’t sexy, but it works.

3. Paying Annoyingly High Fees

Canadian investors continue to pay some of the highest fees in the world, especially when it comes to mutual funds. In the most recent Global Investor Experience report, Canada scored Below Average.

Janet Gray suggests Getsmarteraboutmoney.ca to help with issues like sorting out exactly what you’re paying:

You may pay a sales charge when you buy or sell units or shares of a fund. These sales charges are also known as loads. Funds may be offered with a front-end load, back-end load, low load, or no load. These sales charges are set by the mutual fund company.

Thankfully, some of the more egregious fee grabs have been banned – like the recent ban on deferred sales charges (DSC).

How to Lower Your Fees:

Consider a fee-based account, so you don’t pay a sales charge when buying and selling funds, it’s one client advisory fee.

Know exactly what you’re paying for and carefully read the fund’s prospectus.

Do your research about investment fees and costs.

Keep in mind, when getting financial advice through a bank, advisors are heavily incentivized to peddle the bank’s own lineup of mutual funds, which are more lucrative to the banks than lower-priced products like ETFs.

If you work with an advisor – ask them the total cost that you pay. Not only advisory fees, which are included in the annual fee statement, but also the product cost and any other charges. Then ask yourself: Am I getting value for these fees?

Lastly, fees can be on the higher end of household expenses in a yearly budget. For example, if you have $500,000 invested, and you’re paying 2% in fees, that’s $10,000 a year. Fees matter a great deal to your overall bottom line.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png?w=380&resize=380,250&ssl=1)