Table of Contents Show

The more things change, the more they stay the same in the land of balanced funds. Morningstar’s 2024 Balanced Fund Landscape for Canadian Investors highlights the ongoing trends in product development, investor flows, fees, and performance of multi-asset funds – a one-stop option for investors looking for diversified portfolios.

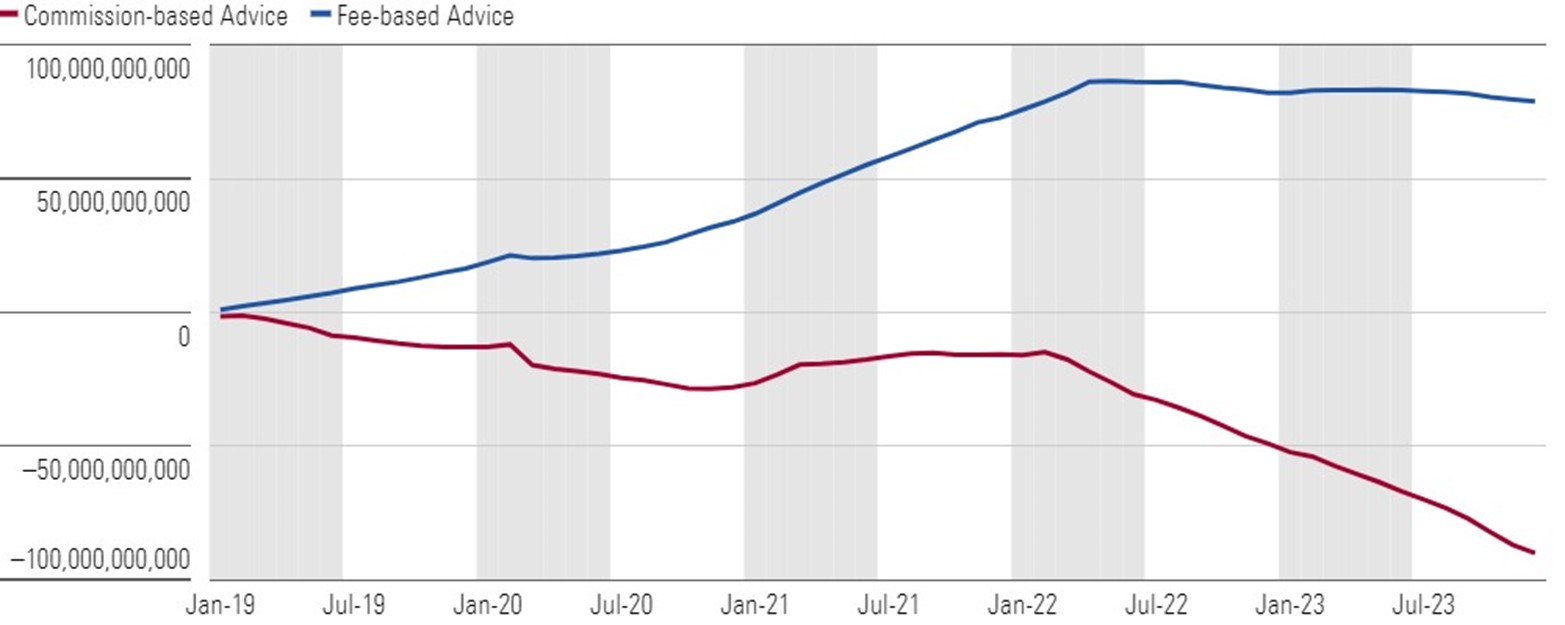

Commission-Based Exodus in Canada

Canadians may have long favoured fee-based advice share classes, and have trickled out of commission-based share classes, but this disparity expanded drastically over the last two years. Nearly 83% of the C$90 billion in net outflows experienced by commission-based share classes over the last five years have occurred since 2022. To put it another way, total retail assets of the fee-based share classes grew by C$113 billion over the past five years, while commission-based share classes only grew by C$6 billion.

This change also contributed to a slight narrowing of market leadership. The asset management arms of the six largest Canadian banks (RBC, TD, BMO, CIBC, Scotiabank, and National Bank) manage 51.5% of all retail balanced assets as of December 2023, 1.3 percentage points less than their peak in March 2022.

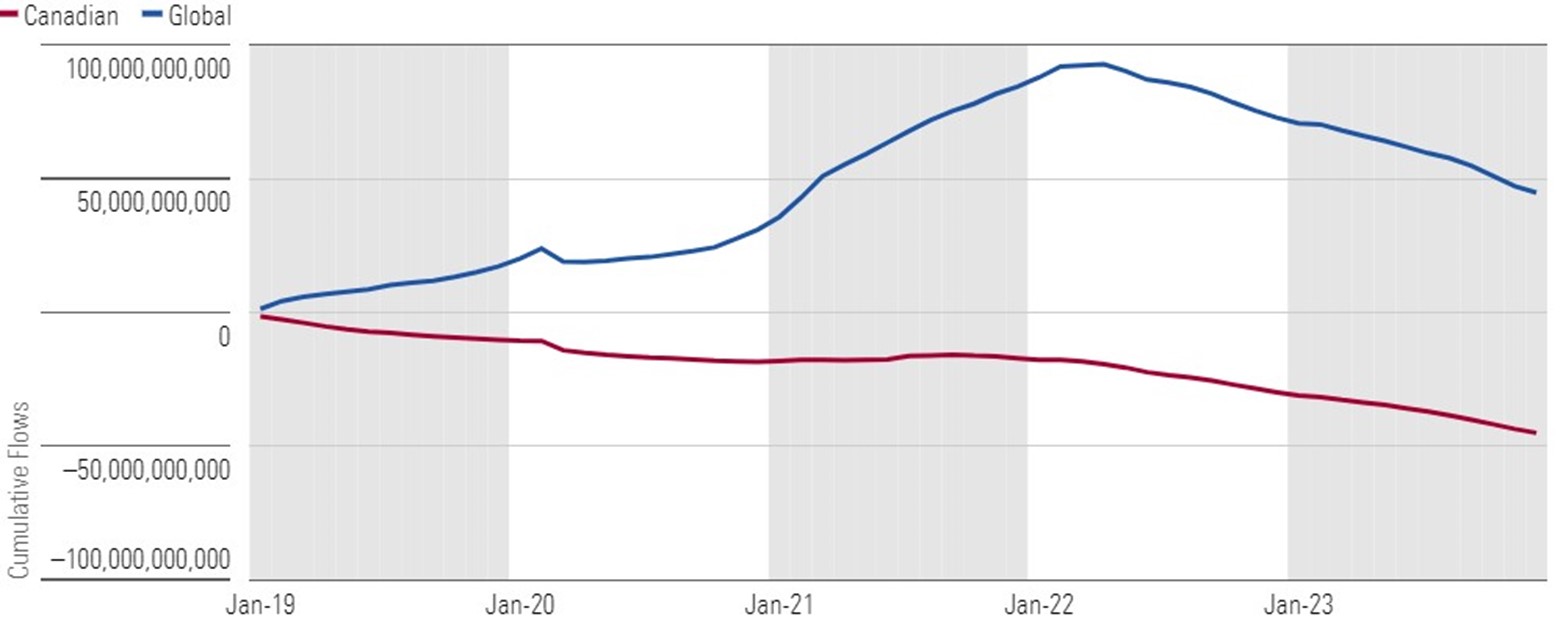

Canadians Continue to Prefer Global Funds

Canadians continue their long-time preference for globally oriented strategies and disfavour for Canadian-oriented ones. Global balanced funds (those that hold less than 70% of assets in Canadian stocks and bonds) took in more than C$44 billion in net flows for the past five years ending December 2023. This nearly matches the amount Canadian investors took out of Canadian balanced funds at C$45 billion in net outflows over the same period.

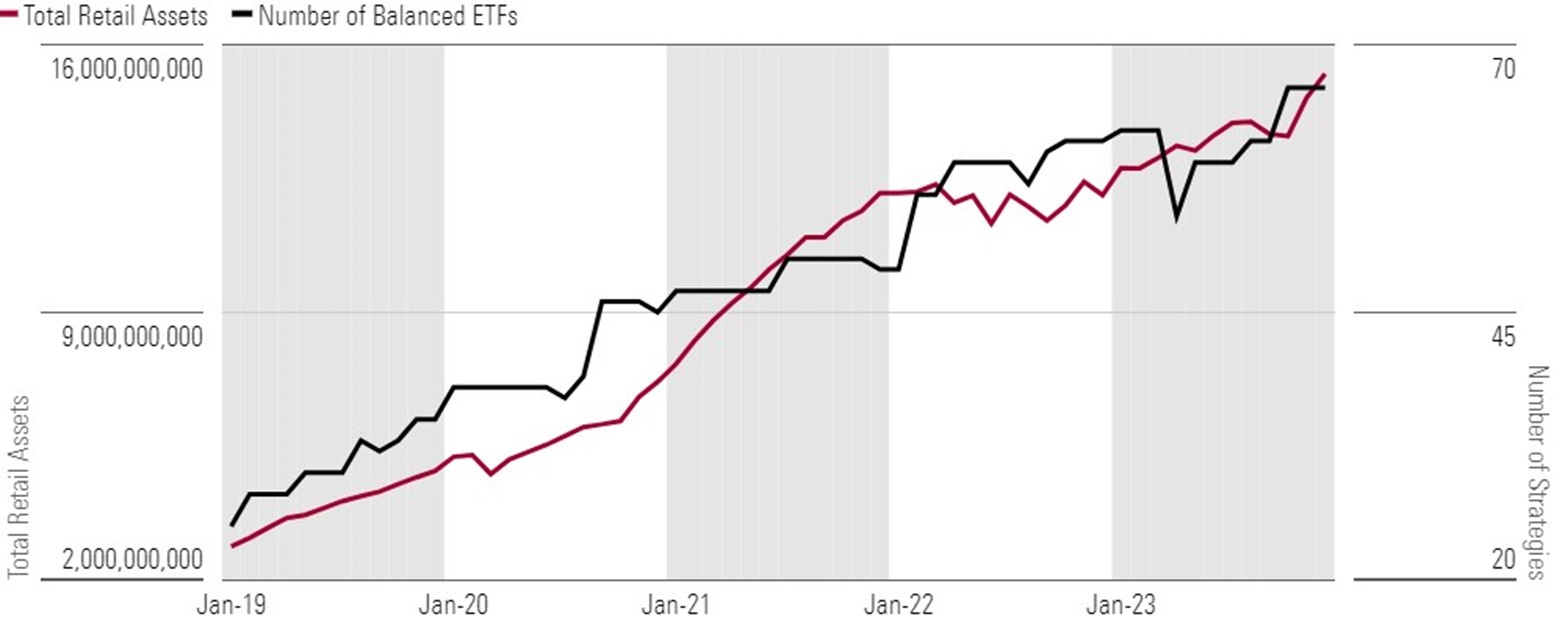

ETFs Breaking into Balanced Fund Space

Balanced exchange-traded funds (ETFs) continue to capture investor attention, and firms continue to introduce more options. These vehicles gathered C$4 billion from January 2022 to December 2023. This contrasts against the C$71 billion of redemptions for mutual funds over that same time. The number of unique balanced ETFs stands at 66, more than double what it was in January 2019.

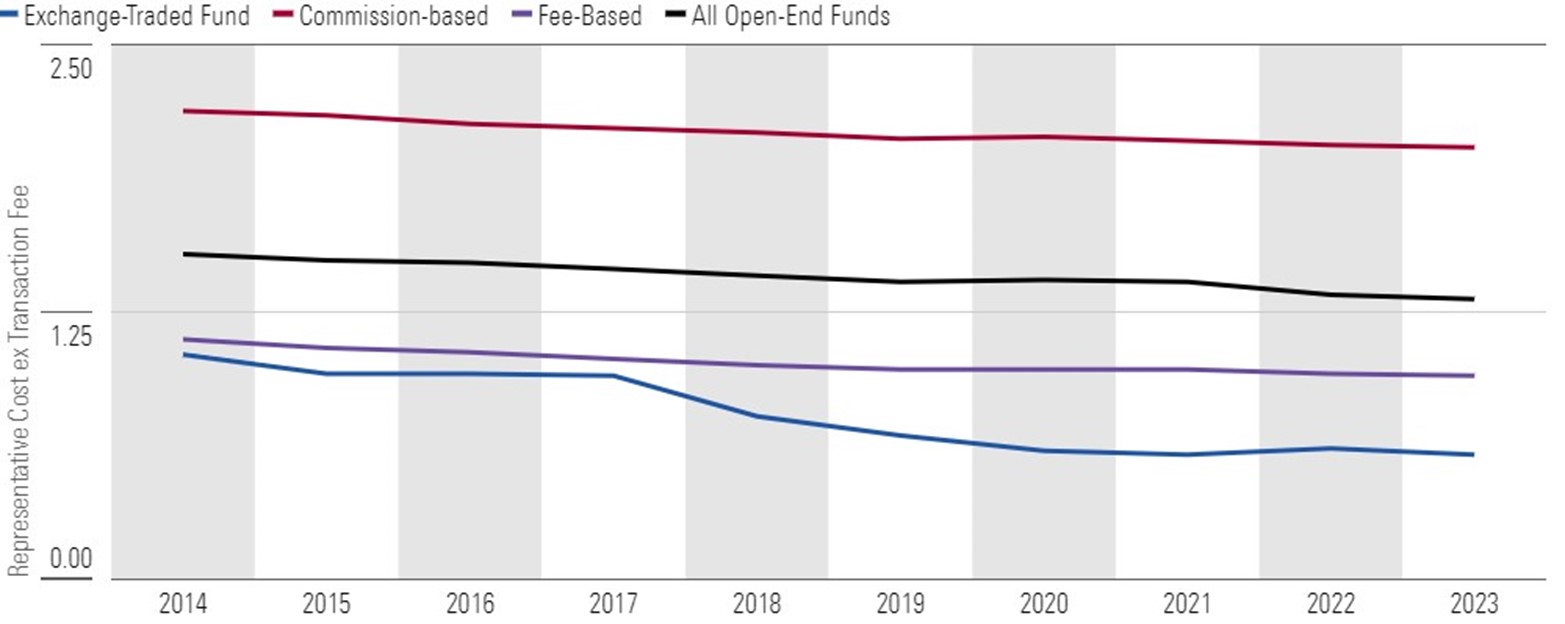

Canadian Mutual Fund Fees Fall

And fees faced by Canadian investors also continue to fall. The average fee for mutual funds fell 21 basis points (0.21%) while the average fee for ETFs fell 47 basis points (0.47%).

What We’re Watching for in 2024

Innovations and new approaches to portfolio management continue to be tested. Alternative investments in retail mutual funds continue to rise in prominence. While regulation limits these funds to, at most, 10% of their overall portfolios, many firms are allocating small portions of their strategy to private equity, infrastructure, real estate, and in some cases even cryptocurrency. Large firms like CI Investments, TD, RBC, BMO, and more have announced partnerships or acquisitions of alternative asset managers in recent years. Others, like Manulife, already had in-house offerings.

Canadians already have exposure to such asset classes through the Canada Pension Plan. CPP Investments – the investing arm of CPP – already allocates large portions of its portfolio to private equity and infrastructure. Others like the Ontario Teachers’ Pension Plan (OTPP) and British Columbia Investment Management Corporation (BCI) also maintain a significant amount of alternatives.

It will be important to discern how these changes will benefit retail investors.