Table of Contents Show

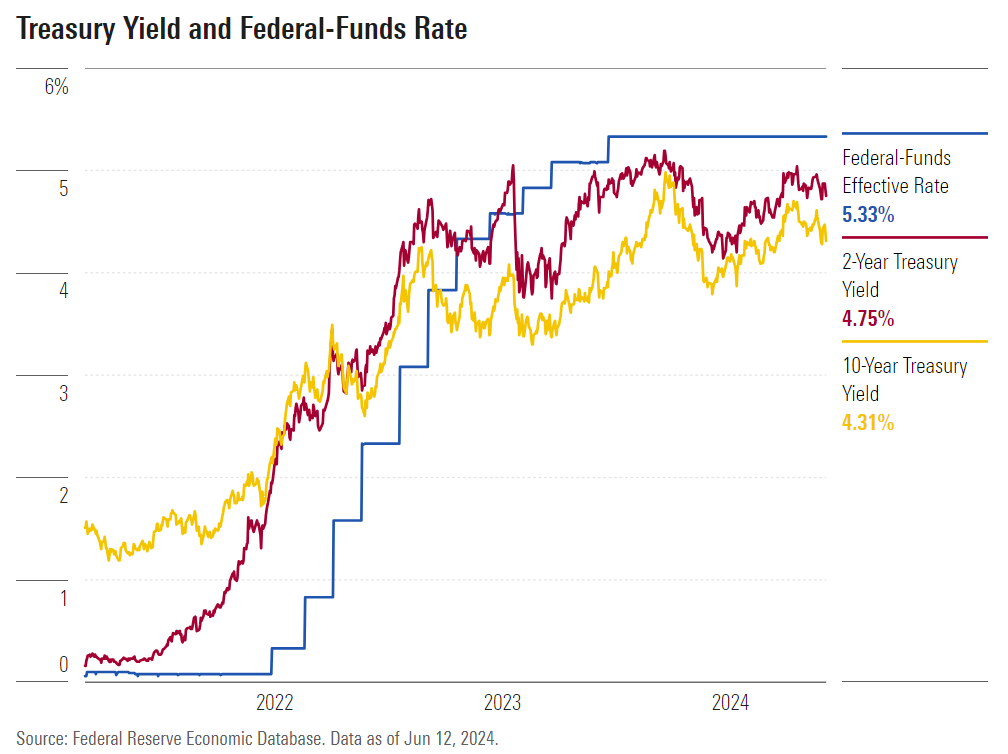

Rate cuts are coming. It already happened in Canada. It may not happen in the U.S. until September, December, or even 2025, but market watchers agree the Fed will eventually ease policy as inflation improves. That means those cushy 5% rates on money market funds will go lower.

With the outlook for bonds looking better, strategists say investors should look to fixed income to lock in higher yields and protect their portfolios against market volatility in the second half of 2024.

To be clear, bonds and cash serve very different functions in portfolios. Cash will always be the safest bet for short-term spending needs. Bonds, while safer than equities, will always carry some risk of losing money. The longer-term the bonds, the greater the risk of short-term price swings when interest rates rise or fall.

But for investors looking to put some extra cash to work or rebalance a portfolio, there’s an answer to the question of whether it’s time to move into longer-term investments, especially since yields on money market funds tend to rapidly fall when changes occur. “The short answer is: absolutely. [Investors] need to start thinking about doing it now,” says Daniel Siluk, head of global short duration and liquidity at Janus Henderson Investors.

Yields May Keep Falling

Yields on the 10-year Treasury note peaked for 2024 at 4.7% in late April, after three consecutive months of hot inflation data fueled investor fears that the Fed was losing the fight against inflation. Those yields have since fallen to 4.24% as of Thursday, thanks to cooling inflation data.

Strategists expect the decline to continue in the second half of the year. Kathy Jones, chief fixed income strategist at Schwab, points to improved inflation, a softening labor market, slower economic growth, and rate cuts from central banks around the world. “The weight of all that will pull down yields,” she says.

If yields do begin to tick down again, locking in duration ahead of time can help investors preserve the income on their bond holdings. “Starting yields matter a lot,” says Mike Cudzil, fixed-income portfolio manager at Pimco. The yield on your portfolio today is more or less the return you can expect on that portfolio over three to five years, he explains. Combine that with the potential for price appreciation if yields fall, and “fixed income is quite attractive.”

Strategists: It’s Time to Start Locking In Duration

Against that backdrop, “our guidance has been that people should extend duration and not just stay in cash,” Jones says.

Duration is a measure of interest-rate sensitivity and is often used when discussing bond maturities. Longer-term bonds have greater duration then shorter-term bonds.

While money market returns may be attractive right now, investors will see them fall rapidly once the Fed’s rate-cutting cycle begins. “Reinvestment risk hurts money market investors really quickly,” says Siluk. “The yields on those accounts just drop like a stone.”

Of course, this doesn’t mean investors should liquidate their cash holdings and move into riskier investments in one go. Siluk says investors can extend duration slowly. Oftentimes, this process happens first through short-dated investment-grade bonds, and then more intermediate longer-dated bonds. Falling yields also mean more price appreciation for bonds, which investors can’t achieve with cash.

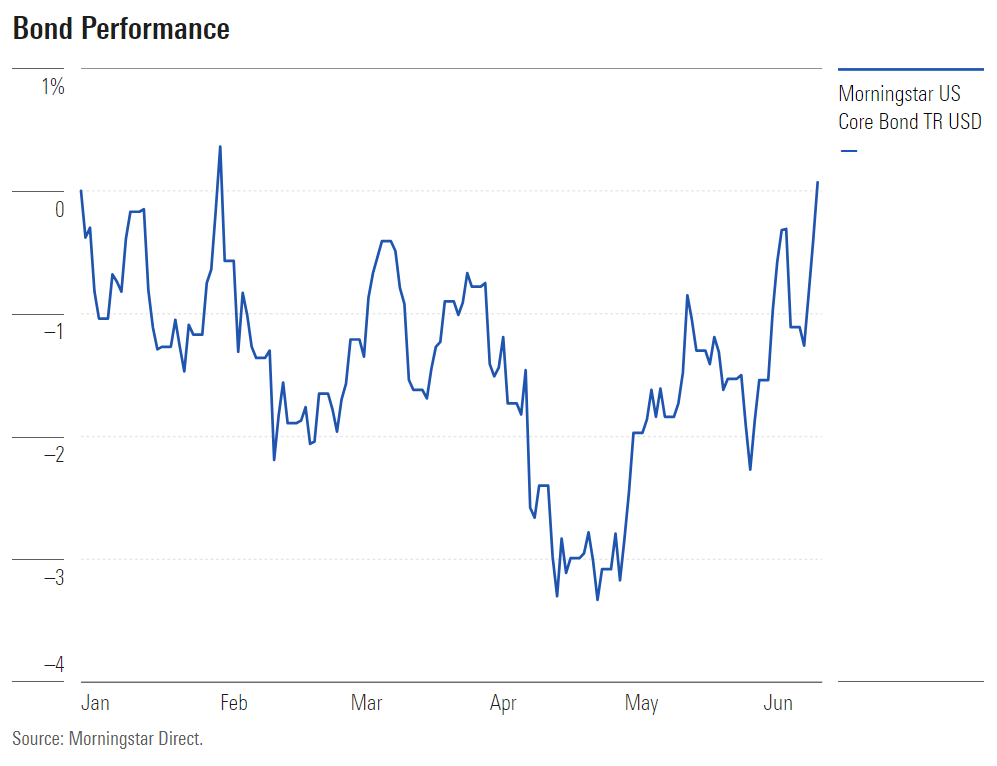

A transition into longer-duration investments “can drive some capital price appreciation, which you’re not going to get in money markets,” Siluk says. To some degree, this is already happening; the Morningstar Core US Bond Index is up 1.38% over the past month.

Look Beyond Treasuries for Higher Yield

Giving up a 5% yield on a money market fund for a potentially lower yield on a Treasury note is a “tough trade to make,” Jones acknowledges. She recommends investors look beyond Treasuries to lock in more attractive yields while still extending duration, which can help ease the sting of moving out of cash while rates are still high.

“You could go to a different market like investment-grade corporate bonds,” Jones says, “and you can capture that 5%-plus yield for five to seven years without taking huge credit risk.” Another option is agency mortgage-backed securities, while investors in high tax brackets may also look to municipal bonds. “Don’t focus just on Treasuries,” she says. “Focus on where the opportunities are elsewhere.”

Siluk points out that a portfolio of short-dated investment-grade bonds could yield somewhere around 5% or even 6%. Compared to the long-run average annual returns of the stock market, “that’s pretty attractive.”

More Bond Benefits

In general, strategists are bullish on fixed income in the months and years ahead. That’s welcome news after the historic losses bond investors endured in 2022 and a bumpy 2023.

And while rates are expected to fall somewhat, strategists don’t anticipate a return to the rock-bottom levels of the last 15 years. Cudzil says relatively higher yields mean more opportunities for investors, and more protection if yields eventually tick up again. While starting yields a few years ago didn’t afford much wiggle room, today’s inflation-adjusted yields above 2% are a different story. “You can tolerate a move to higher yields and still have positive returns,” he says. “That repricing has now led you to a decent cushion.”

And if the economy begins to falter, strategists say bonds could once again act as a powerful diversifier within portfolios. “You’ll start to see asset allocators use fixed income more for that hedging quality,” Siluk says.

“Over a long period, it pays to have fixed income in your portfolio,” Cudzil explains. “It dampens volatility, it’s the certainty of cash flows … it makes a lot of sense to have more fixed income today than in the past.”

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VYKWT2BHIZFVLEWUKAUIBGNAH4.jpg?w=1920&resize=1920,1024&ssl=1)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png?w=380&resize=380,250&ssl=1)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg?w=380&resize=380,250&ssl=1)