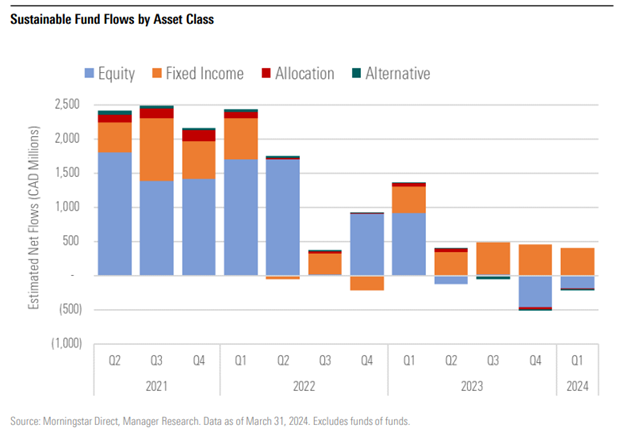

Sustainable funds in Canada started the year strong and saw an estimated $193.3 million in inflows in the year’s first quarter, the latest Morningstar Canada Sustainable Fund Landscape for Q1 2024 found.

Canadian sustainable funds made a swift return to inflows after the segment’s first quarterly outflows in Q4 2023 since early 2019. Canadian investors continue to show interest in sustainable funds as assets once again hit all-time highs and totalled over $51 billion in assets.

With continued growth comes continued observations around trends in the space. Highlights from the report include:

1) Canadian Sustainable Fixed-Income Funds Continue to Dominate

Investors continue to favour fixed income over any other asset when it comes to sustainable funds. Bond funds recorded their fifth consecutive quarter of inflows that totalled $407.6 million. It remains the only asset class to gain assets over the last year, outpacing even equity funds which is the largest asset class of sustainable funds in Canada.

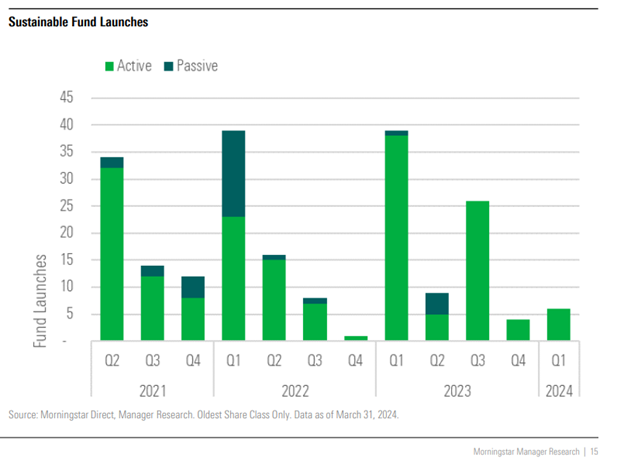

2) Most Canadian Sustainable Funds are Actively Managed

Six new sustainable funds were added in Q1 2024, all of which follow an actively managed approach. This represents the third consecutive quarter with no new sustainable passive funds launched. Five asset managers launched funds sustainable funds which offer diversity across asset classes. NEI Investments, OneVest, Manzil and Mackenzie each launched one, and Educators launched two.

3) Sustainable Fund Performance was Mixed in Q1

Sustainable funds posted mixed results, with 58% landing in the bottom half of their respective peer groups. Sustainable allocation funds, led by those in the Global Neutral Balanced category, had the strongest relative results, with 26% landing in the top quartile. However, Canadian sustainable balanced funds struggled, with 67% landing in the bottom quartile. Sustainable equity and fixed-income funds, where US and global-oriented portfolios outperformed those with a domestic focus, posted similar results.

Sustainable funds also lagged on a one-year basis, as 52% of funds landed in the bottom half of their respective peer groups. Fixed-income funds performed admirably, with over 64% landing in the top half. The reverse is true for equity funds, where only 42% posted results in the top half.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QPMKPA6BWRCWVO64V5UQWWMPFI.jpg?w=380&resize=380,250&ssl=1)