Table of Contents Show

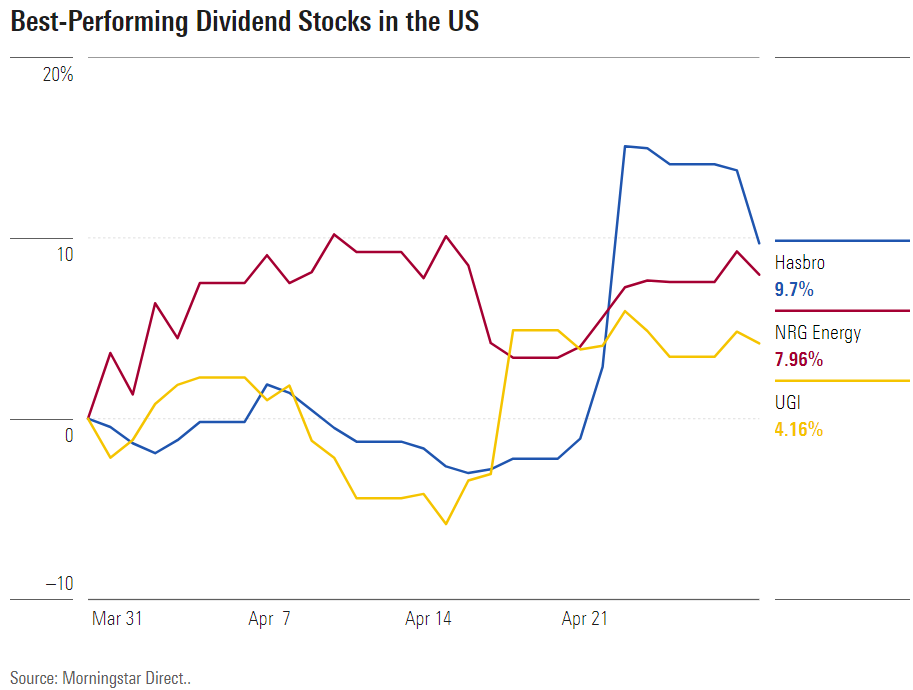

Dividend-paying stocks that combine healthy balance sheets with hefty yields can provide investors with steady incomes, cushion against market downturns, and grow investments at a healthy clip. In April 2024, the top-performing dividend payers included leisure company Hasbro HAS, independent power producer NRG Energy NRG, and regulated gas company UGI UGI.

To find the month’s 10 best-performing income-focused stocks, we screened the Morningstar Dividend Leaders Index, which tracks the performance of the 100 highest-yielding stocks from a broad basket of consistent dividend payers.

The Top-Performing US Dividend Leaders of April 2024

Hasbro HAS

NRG Energy NRG

UGI UGI

Philip Morris International PM

Avista AVA

Pioneer Natural Resources PXD

Southern Company SO

3M MMM

OGE Energy OGE

Chevron CVX

How Have Dividend Stocks Performed?

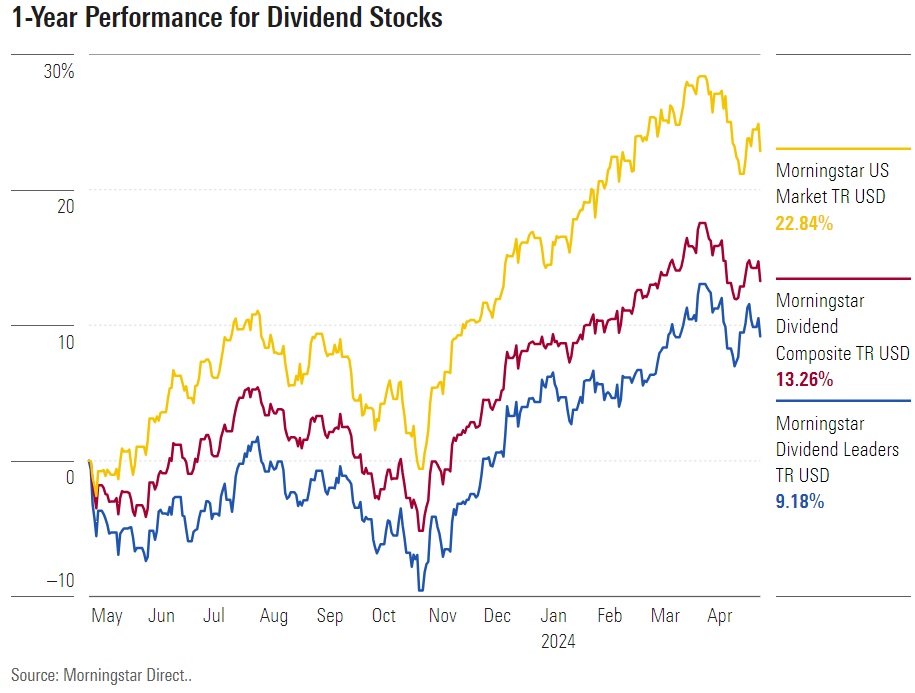

Over the past month, the Morningstar Dividend Leaders Index, which captures the 100 highest-yielding names, fell 3.4%. The broad Morningstar Dividend Composite Index lost 3.6%. In the 12 months leading up to April 30, the Dividend Leaders Index gained 9.2%, while the Dividend Composite Index gained 13.3%.

The Morningstar US Market Index lost 4.3% on the month but has risen 22.8% on the year.

Yields and Metrics for the Best-Performing Income Payers

Hasbro

Leisure company Hasbro rose 9.7% in April and gained 8.2% over the past 12 months. Trading at $61.30 per share, its stock has a forward dividend yield of 4.57%. Hasbro pays investors an annual dividend of $2.80 per share. The stock, which has a narrow economic moat, is trading at a 27% discount to its fair value estimate of $84 per share, leaving it with a Morningstar Rating of 4 stars.

NRG Energy

Independent power producer NRG Energy rose 8.0% in April and gained 117.3% over the past 12 months. At $72.67 per share, its stock has a forward dividend yield of 2.24% and an annual dividend of $1.63 per share. The stock, which has no economic moat, is significantly overvalued, trading 77% above its fair value estimate of $41 per share. It has a Morningstar Rating of 1 star.

UGI

Regulated gas company UGI gained 4.2% in April and fell 20.1% over the past 12 months. The stock’s $25.56 price gives it a forward dividend yield of 5.87%. UGI pays investors an annual dividend of $1.50 per share. The stock has a quantitative Morningstar Rating of 3 stars.

Philip Morris International

Tobacco company Philip Morris International rose 3.6% in April and ended the past 12 months near zero. Trading at $94.94 per share, Philip Morris International stock has a forward dividend yield of 5.48% and an annual dividend of $5.20 per share. The stock, which has a wide economic moat, is trading near its fair value estimate of $103 per share. It has a Morningstar Rating of 3 stars.

Avista

Utilities company Avista gained 2.7% in April and fell 14.1% over the past 12 months. Trading at $35.98 per share, its forward dividend yield is 5.28%. Avista pays investors $1.90 per share annually. It has a quantitative Morningstar Rating of 3 stars.

Pioneer Natural Resources

Oil and gas exploration and production company Pioneer Natural Resources gained 2.6% in April and rose 28.8% over the past 12 months. At $269.32 per share, Pioneer Natural Resources stock has a forward dividend yield of 4.06% and an annual dividend of $10.24 per share. The stock, which has a narrow economic moat, is moderately undervalued, trading 13% below its fair value estimate of $309 per share. It has a Morningstar Rating of 4 stars.

Southern Company

Regulated electric company Southern Company rose 2.5% in April and gained 3.7% over the past 12 months. Trading at $73.50 per share, Southern Company stock has a forward dividend yield of 3.92% and an annual dividend of $2.88 per share. The stock, which has a narrow economic moat, is trading near its fair value estimate of $69 per share. It has a Morningstar Rating of 3 stars.

3M

Conglomerate 3M rose 2.3% in April and gained 7.9% over the past 12 months. Trading at $96.51 per share, 3M stock has a forward dividend yield of 6.26% and pays investors an annual dividend of $6.04 per share. The stock, which has a narrow economic moat, is currently trading near its fair value estimate of $104 per share, leaving it with a Morningstar Rating of 3 stars.

OGE Energy

Regulated electric company OGE Energy gained 2.2% in April and fell 3.3% over the past 12 months. The stock’s $34.65 price gives it a forward dividend yield of 4.83%. OGE Energy pays investors an annual dividend of $1.67 per share. With a fair value estimate of $38 per share and no economic moat, the stock is moderately undervalued, trading at a 9% discount. It has a Morningstar Rating of 4 stars.

Chevron

Oil and gas firm Chevron rose 2.2% in April and ended the past 12 months near zero. At $161.27 per share, Chevron has a forward dividend yield of 4.04% and an annual dividend of $6.52 per share. The stock, which has a narrow economic moat, is trading near its fair value estimate of $176 per share. It has a Morningstar Rating of 3 stars.

What Is the Morningstar Dividend Leaders Index?

The Morningstar Dividend Leaders Index captures the performance of the 100 highest-yielding stocks that have consistent records of paying dividends and can sustain those payments.

It’s a subset of the Morningstar US Market Index (which represents 97% of equity market capitalization) that includes only securities whose dividends are qualified income. Real estate investment trusts are excluded. Companies are screened for dividend consistency and sustainability. Each must have a positive five-year dividend per share growth and a dividend coverage ratio greater than 1. The 100 highest-yielding stocks are included in the index, weighted by the dollar value of their dividends. See the full rulebook here.

Companies that are not formally covered by a Morningstar analyst have quantitative ratings. These companies are statistically matched to analyst-rated companies, allowing our models to calculate a quantitative moat, fair value, and uncertainty rating.

This article was compiled by Bella Albrecht and edited by Lauren Solberg.

As part of our mission to put more information into the hands of investors, this article was compiled from Morningstar’s data and independent research using automation technology. The original article was written by Morningstar reporters and editors. This updated version was reviewed by an editor.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png?w=1920&resize=1920,1024&ssl=1)