Table of Contents Show

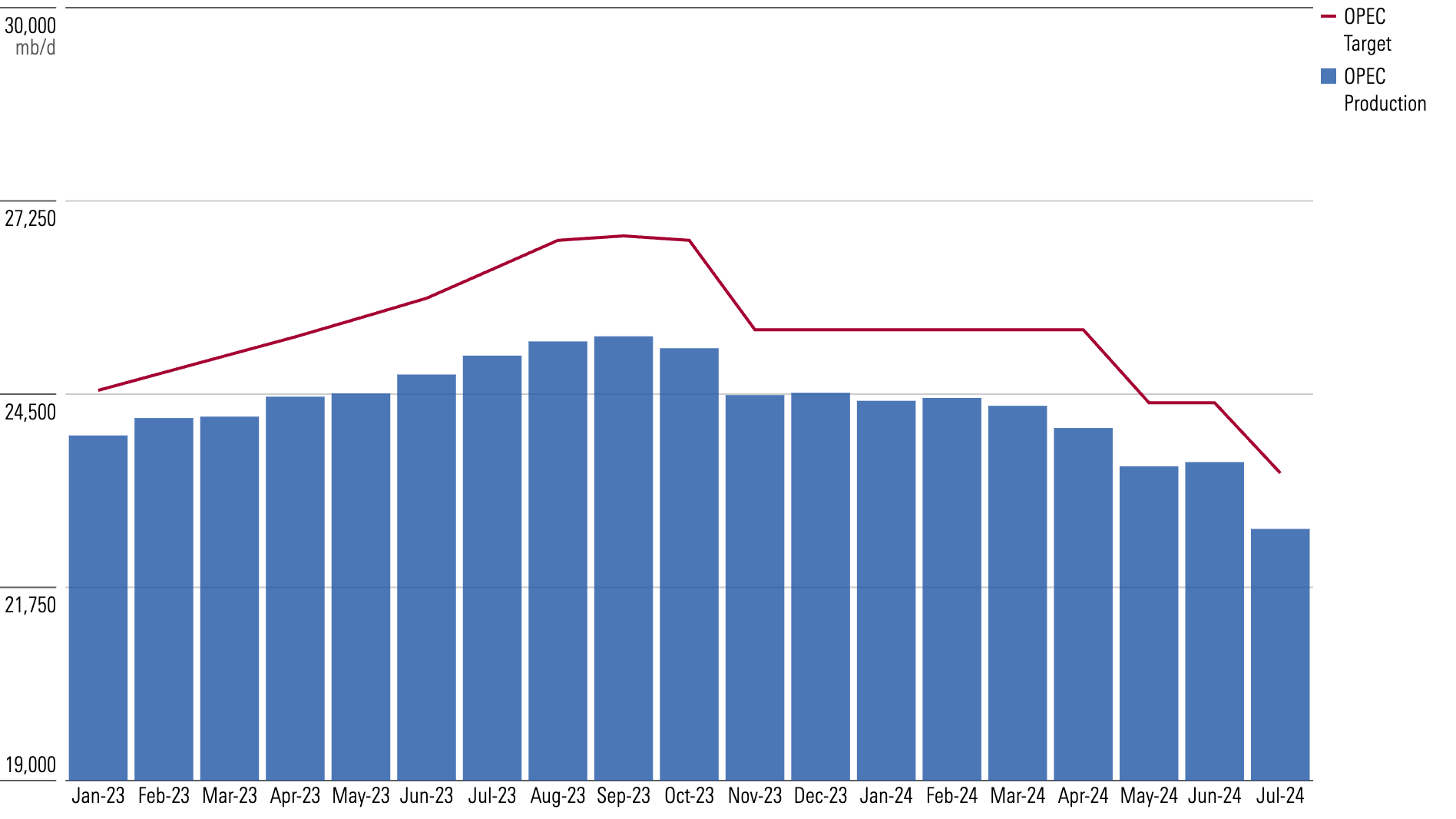

OPEC’s plans to begin increasing supply by 2.2 million barrels per day in December continues to reflect unwarranted optimism about the oil markets.

We think the environment was just as fragile a few months ago when OPEC first announced its plans, and the new two-month delay does not solve the issue. Effectively, OPEC is hoping oil demand suddenly grows markedly stronger, which is unlikely.

This position is echoed by the Energy Information Administration, the International Energy Agency, and OPEC itself, who are all cutting oil demand estimates by varying degrees.

The forecast is largely linked to China, where oil imports have declined on a year-over-year basis about 3%. Oil import declines are primarily because of slowing economic activity from housing and building construction, but also liquefied natural gas substitution in place of diesel in heavy-duty trucks.

Bringing Back Production Cuts Won’t Be Easy for OPEC

On the gas side, US gas inventories remain at the top end of their historical ranges, but we expect warmer summer weather will draw down inventories in the near term. European storage levels remain at extremely healthy levels, though gas prices have experienced significant near-term volatility.

The European gas market’s main concern is its sensitivity to perceived supply disruptions, including the expiration of Russian supply contracts by the end of 2024.

Get the full report: Q3 2024 Oil and Gas Industry Pulse

Here, we outline our expectations for the oil and gas industries and the companies that are best positioned to succeed amid this environment.

3 Key Themes for the Oil & Gas Industries

Supply concerns pressure oil prices. Oil prices are taking a hit this quarter, as supply concerns remain the top focus for investors. We certainly agree with this stance, as OPEC recently pushed back its plans to add barrels back to the market to December 2024. It now plans to add barrels from December 2024 to September 2025, compressing the time frame for restoration of barrels by two months. If OPEC proceeds with this plan, we expect the market will grow even more oversupplied, given the brittle nature of oil demand. Further oil price downside remains highly likely. Demand data over the next month or two is likely to heavily influence future extensions.

LNG prices start to reflect 2025 market strength.The opposite reactions of Henry Hub and Asian and European LNG prices this quarter speak to the more optimistic 2025 LNG outlook. Henry Hub prices are crashing because of region-specific delays on new LNG capacity and outages at another key LNG export terminal. However, European and Asian LNG prices are spiking based on a more robust LNG demand profile in 2025 as new LNG capacity comes online. LNG prices are now low enough to where price-sensitive consumers like China and India are ramping up imports, but we don’t expect Henry Hub prices will trough for long, given US gas’ robust demand profile.

Market weakness damps energy stock prices. Given the overall market’s concerns regarding oil supply, investors trimmed energy stock prices this quarter. We would require further downside before we could declare widespread industry bargains. We’d be particularly interested in gas-leveraged names, given the potential for higher gas demand from AI and data center applications as a backstop for intermittent solar and wind. Watchlist names would include Range Resources RRC and Antero AM but also Kinder Morgan KMI, Williams WMB, and Enbridge ENB.

Our Forecasts: Oil & Gas Industries

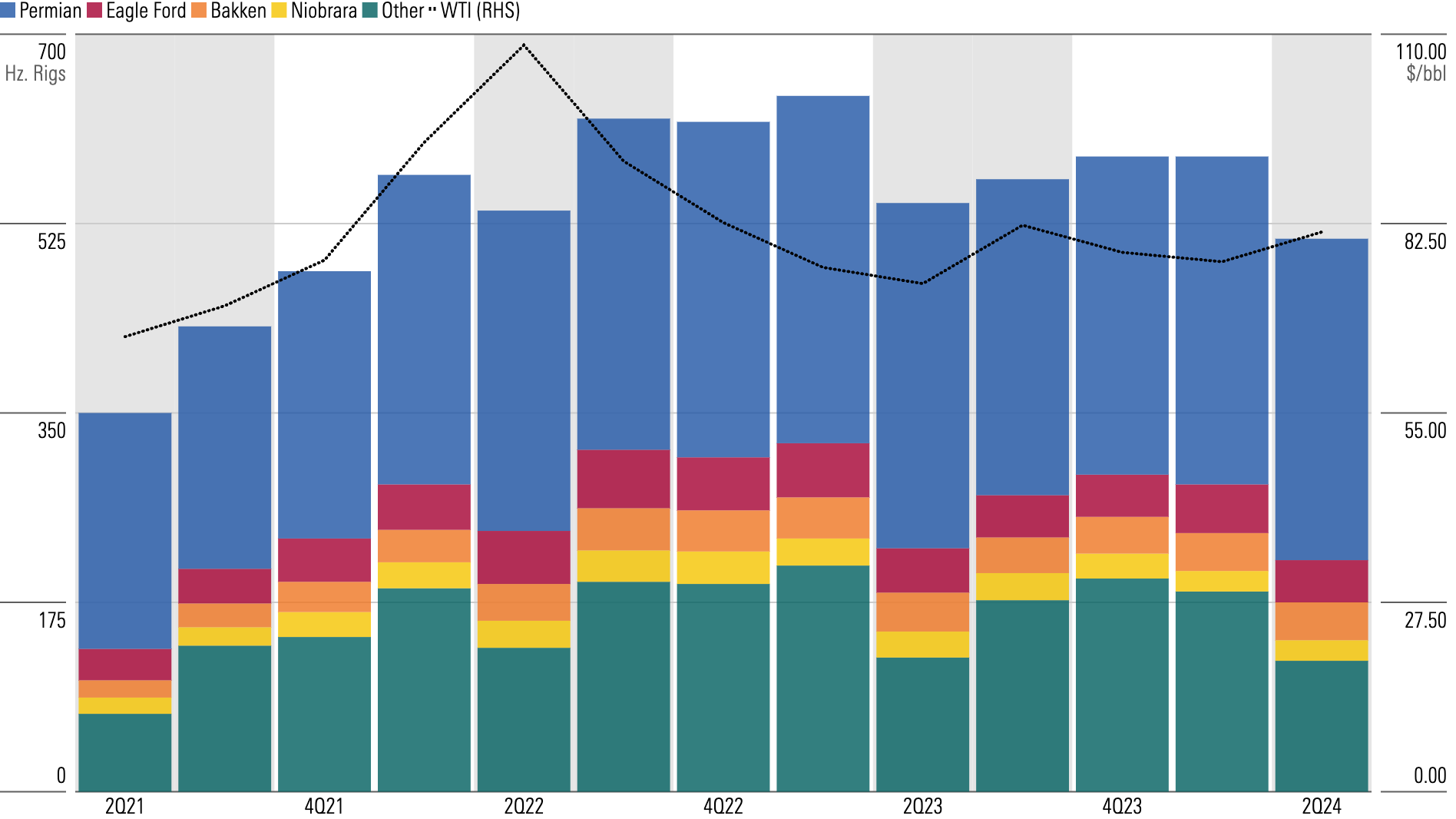

Ongoing US exploration and production consolidation will likely pressure oil rig activity levels.

Public operators cull rigs from acquired producers’ drilling programs, which focused more on a high-growth operating model. We favor more of a “lower for longer” approach for drilling rig activity.

US producers have reported ongoing material efficiency improvements in the Permian Basin, the highest-producing oil field in the US, during the second quarter. These improvements are primarily through longer wells, at the expense of adding more acreage inventory over the long run. We see this strategy as using a longer straw to deplete a larger portion of a reservoir, versus a wider straw over a narrower portion of the oil window.

Oil Rig Activity to Remain Lower for Longer Because of Production Efficiencies

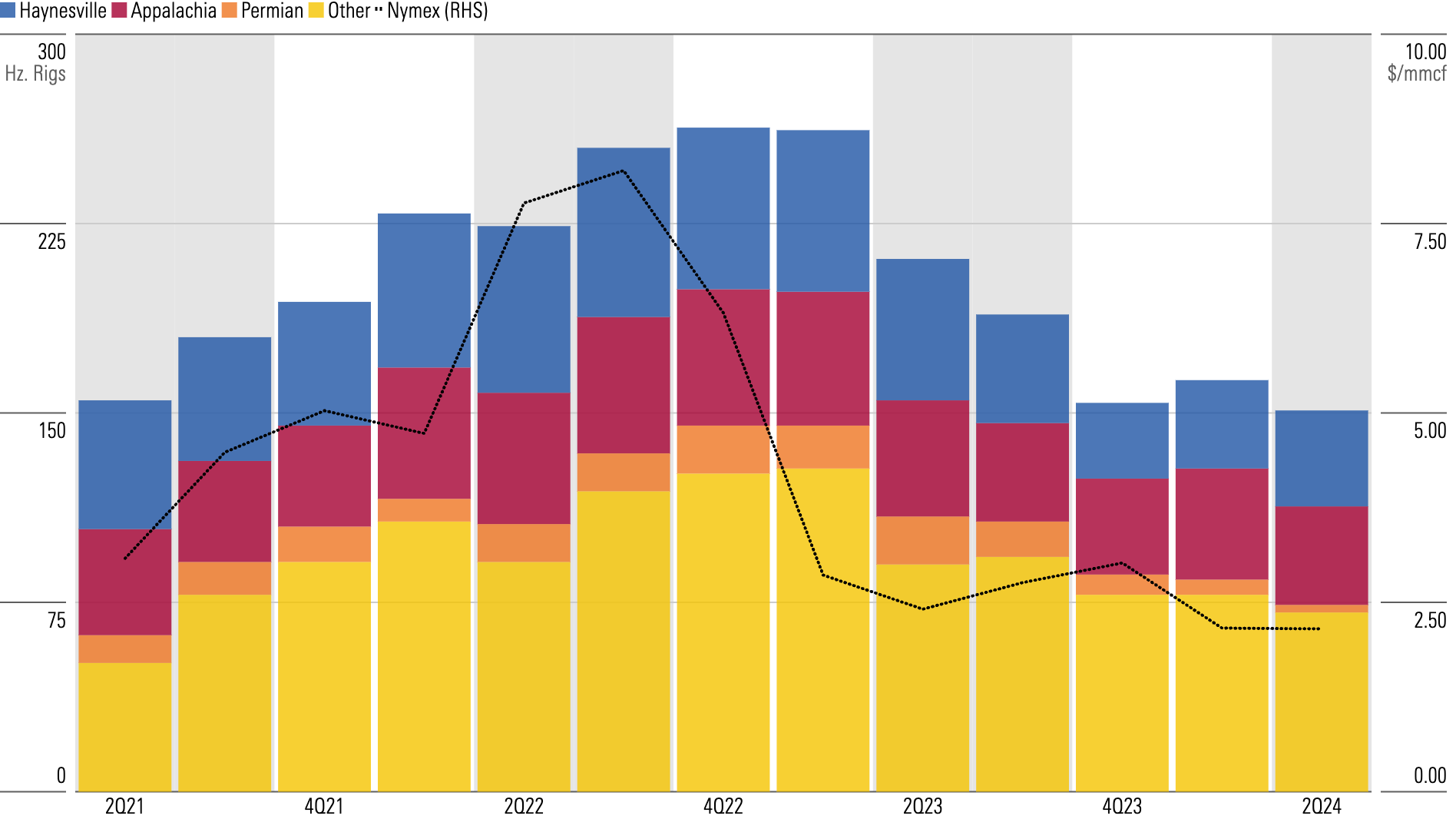

On the gas side, we think the outlook is improving after a challenging first half of the year.

However, the improved outlook doesn’t mean more drilling activity. Rather, we expect US gas producers will focus initially on previously shut-in wells or deferred wells for near-term production gains at minimal cost. Higher gas prices support this shift: US gas inventories are at the point where they will no longer provide a material overhang. This is especially the case with US LNG export and AI and data center demand.

After Challenging First Half, Gas Producers Have Better Near-Term Outlook

4 of the Most Attractive Energy Picks

Energy sector bargains have sharply declined this year. Of our energy coverage, 28% remains undervalued (4 or 5 stars), right around where it was in our last report.

Our top picks in the energy sector include:

1. New Fortress Energy NFE: The market reacted harshly to New Fortress’ failure to meet key production milestones in its first LNG production facility, increasing near-term debt concerns. We see this as an overreaction, given the clear path to volume growth and deleveraging.

2. Schlumberger SLB: SLB’s leading-edge technological advancements continue to distinguish the firm from peers. Its myriad innovations consistently add value for customers.

3. ExxonMobil XOM: Exxon plans to double earnings and cash flow from 2019 levels by 2027 on a combination of structural cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments.

4. APA APA: APA is hoping for a game changer with its exploration assets in Suriname. The firm has announced a string of promising discoveries and may have a final investment decision in 2024.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png?w=380&resize=380,250&ssl=1)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png?w=380&resize=380,250&ssl=1)