Key Morningstar Metrics for Micron Technology MU

What We Thought of Micron Technology’s Earnings

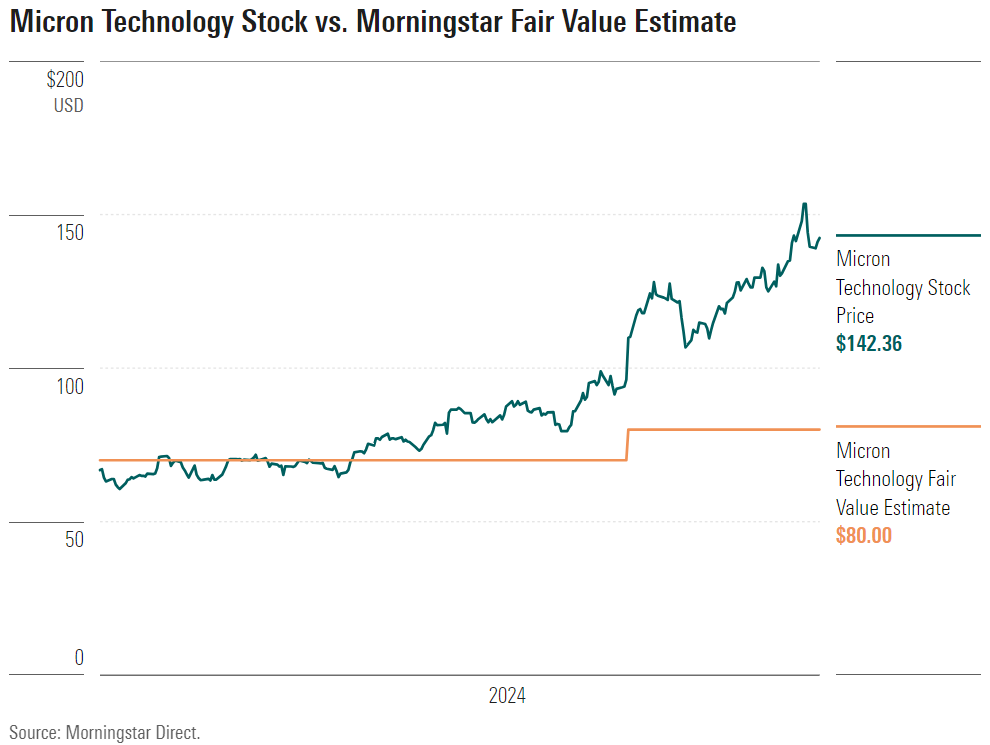

We raise our fair value estimate for Micron Technology MU to US$110 per share from US$80, behind a higher medium-term growth and margin forecast. We now expect significant growth through fiscal 2026 for Micron, driven primarily by higher expectations for its dynamic random-access memory, or DRAM, business. We believe high-bandwidth memory, or HBM, will augment growth, but we also expect standard DRAM to benefit from strong pricing over the next few years. Investment in artificial intelligence will meaningfully contribute to our forecast across both HBM and standard DRAM. We see demand outpacing supply through 2025, supporting high prices that should drive strong revenue. We also expect gross margins to benefit from strong pricing and a rising mix of HBM revenue, which is already margin-accretive.

Micron’s fiscal third-quarter results aligned with our updated forecast, and the firm continues to rebound meaningfully from a cyclical trough in fiscal 2023. Shares dropped as much as 7% after hours upon results, which we attribute to the market wanting even better guidance from AI. We see shares as overvalued, even at our new valuation. In the long term, we continue to see Micron as cyclical, and we expect softer results after our forecast for increasingly normal strength through fiscal 2026.

May-quarter revenue rose 82% year over year and 17% sequentially to US$6.8 billion, as Micron continues to recover revenue from a sharp cyclical downturn in fiscal 2023. Both DRAM and NAND revenue rose in line with firm revenue growth. We expect sequential growth to continue for DRAM and NAND through fiscal 2025, and for Micron to reach record revenue in fiscal 2025 and 2026. Micron’s gross margin is improving in line with revenue, and we similarly expect margin expansion through fiscal 2026.

The author or authors do not own shares in any securities mentioned in this article.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg?w=1920&resize=1920,1024&ssl=1)