Table of Contents Show

Semiconductor firm Nvidia NVDA announced a 10-for-1 stock split along with its blowout first-quarter earnings results on Wednesday. The split means investors will receive nine additional shares for each one they already own.

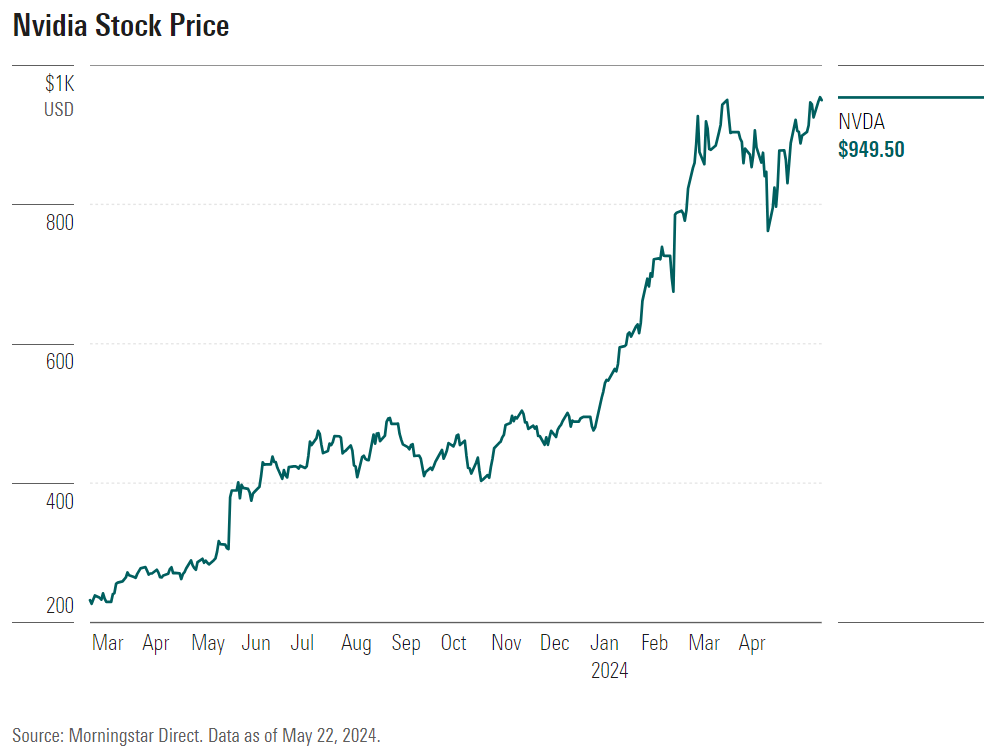

“The split is reasonable since the stock price has appreciated so significantly,” says Morningstar technology equity strategist Brian Colello. Nvidia shares are up more than 90% this year and more than 200% over the past 12 months. The firm’s last stock split was in July 2021, when it issued three new shares for every one outstanding (a four-for-one split).

The Date for Nvidia’s Stock Split

According to the company’s press release, the split is slated to occur after the stock market’s close on June 7. Shares will trade on a post-split basis starting June 10.

What Nvidia’s Stock Split Means

Colello raised his fair value estimate for Nvidia stock from US$910 to US$1,050 following the company’s first-quarter results, which saw revenue of US$26 billion—an 18% increase over the previous quarter and a 262% increase over the year-ago quarter.

While the split will increase the number of outstanding shares in circulation, it will not change the company’s overall value or affect Morningstar’s view of its stock. “Splitting the stock shouldn’t create economic value in theory, but it will make the company more accessible to smaller investors,” Colello explains. While US$500 isn’t enough to buy a single share of Nvidia today, he explains, it will be enough to buy several shares after the split.

After the split, Nvidia’s fair value estimate will be adjusted to US$105. The firm’s wide economic moat rating will be unaffected, as will its 3-star rating (meaning the stock is considered fairly valued) and very high uncertainty rating.

Nvidia’s Performance

The firm’s first-quarter earnings show it “remains the clear winner in the race to build out generative artificial intelligence capabilities,” Colello writes. “We’re encouraged by management’s commentary that demand for its upcoming Blackwell products should exceed supply into calendar 2025, and we see no signs of AI demand slowing either.”

Colello is looking ahead to strong revenue growth from data centers over the next several quarters, and he expects additional growth from a higher installed base of AI equipment. He is anticipating revenue of US$29.7 billion in the next quarter—slightly more than Nvidia’s estimate.

Colello doesn’t believe the explosion of interest in AI technology will dent Nvidia’s growth, at least for now. “Given Nvidia’s astronomical growth, we continue to assess the risk of companies buying too many AI GPUs too soon, leading to an air pocket and excess inventory at some point in the future. We see no such signs today,” he writes.

Other Recent Stock Splits

Nvidia isn’t the only major company to split its shares in recent years. Retail giant Walmart WMT enacted a 3-for-1 split in February, while Alphabet GOOG, Tesla TSLA, and Amazon AMZN split shares in 2022.

The author or authors do not own shares in any securities mentioned in this article.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg?w=1920&resize=1920,1024&ssl=1)