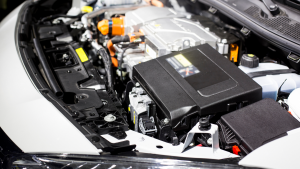

These three battery stocks are positioned to benefit from the green energy transition

Source: AdityaB. Photography/ShutterStock.com

As the global push towards renewable energy accelerates, savvy investors are looking for battery stocks to buy now. With advancements in technology and increased consumer and industrial demand for cleaner energy solutions, battery stocks are becoming increasingly attractive to investors looking for growth in green investments.

As per IEA, the global electric vehicle battery demand has seen a significant surge, increasing by about 65% to 550 GWh in 2022 from around 330 GWh in 2021, driven by a rise in electric car sales.

In the future, the electric vehicle battery market is should expand significantly at a CAGR of 23.5%, from $62 billion in 2024 to $178 billion by 2029. Increased demand for electric vehicles and supportive government policies aimed at boosting EV sales are expected to drive this growth.

The current backdrop creates a fertile ground for investors looking to capitalize on the growth of the EV market. Thus, here are three battery stocks that are well-positioned to benefit from the rise in demand for batteries.

Whether you are looking to diversify your portfolio or strengthen your focus on renewable energies, these battery stocks offer promising potential amid a rapidly evolving energy landscape.

Enovix (ENVX)

Source: Shutterstock

Enovix (NASDAQ:ENVX) is an innovative technology company specializing in the development and manufacturing of advanced silicon-anode lithium-ion batteries.

The company’s recent financial performances and strategic investments in capacity expansion and tech innovation underscore its potential for sustained growth.

Enovix has demonstrated remarkable growth of late, with its Q4 revenue jumping from $1.1 million in Q4 2022 to $7.4 million in Q4 2023. This leap is a testament to the company’s strategic operations and its alignment with cutting-edge market trends.

The company’s recent operational expansions, including the scale-up of its Fab2 facility in Malaysia, have set the stage for its next growth phase, indicating robust future revenue streams.

Despite the company’s growth potential and strong financial foundation, the stock has not done well of late. However, analysts are still bullish on the stock and have an average price target of $29 on the stock. This provides a 343% potential upside in the near-term.

Albemarle (ALB)

Source: Sergii Chernov / Shutterstock.com

Albemarle (NYSE:ALB) is a prominent player in the lithium market. Although lithium prices have been volatile of late, Albemarle has maintained its position as a low-cost leader.

The company has adapted swiftly to industry shifts and has aligned operations to capitalize on long-term growth trends.

Albemarle’s robust financial health, marked by strong cash reserves and a solid balance sheet, positions it well to navigate market uncertainties. The company posted a revenue beat of $177 million, which further iterates Albemarle’s operational excellence.

Albemarle has committed to strategic investments to expand its production capacity and enhance its technological edge.

The company is adapting to current market conditions by re-phasing its organic growth investments and optimizing its cost structure. This involves selectively reducing capital expenditures for 2024 by $300 million to $500 million compared to 2023.

Solid Power (SLDP)

Solid Power (NASDAQ:SLDP) is an innovative technology company specializing in the development of solid-state batteries, primarily for electric vehicles.

The company’s collaboration with industry giants such as Ford and BMW underscores its strategic positioning within the automotive sector.

These partnerships not only bolster the company’s credibility but also provide crucial industry insights and resources that enhance its research and development capabilities.

Solid Power’s focus on solid-state batteries aligns with the automotive industry’s push for improved EV range and safety, creating a market opportunity.

SLDP’s stock is up 18% in 2024, a testament to the market’s optimism in the company’s growth prospects. Wall Street analysts remain bullish on the stock and have an average price target of $3.30 on the stock. This provides a near-term potential upside of 108%.

On the date of publication, Mohammed Saqib did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.