Table of Contents Show

“Some of the highlights include our second consecutive quarter of record operating margins and our second consecutive quarter of record free cash flow ($395.6 million),” president and CEO Ammar Al-Joundi said on an April conference call.

“We remain focused on capital discipline,” he said. “We are absolutely determined at Agnico that increases in gold price go to our owners.”

Agnico is advancing the former Hope Bay gold mine project in Nunavut, where it also operates the Meadowbank and Meliadine gold mines, number three and four in Canada by production. It’s planning a $1 billion underground expansion at Detour Lake that would increase annual output to 1 million oz., making it one of the world’s top-five gold mines.

Upper Beaver

The company expects to give an update in August on developing the Upper Beaver project near Kirkland Lake in northern Ontario as an underground gold and copper mine with a small open pit and processing facility.

In July, Agnico pledged C$93 million for a 9.9% stake in Foran Mining (TSX: FOM), which is advancing the McIlvenna Bay copper-zinc-gold-silver project in Saskatchewan. The major invested C$8.2 million for 13% of First Nordic Metals (TSX-V: FNM) in Finland and boosted its holding in Ontario-focused Maple Gold Mines to 19.9%.

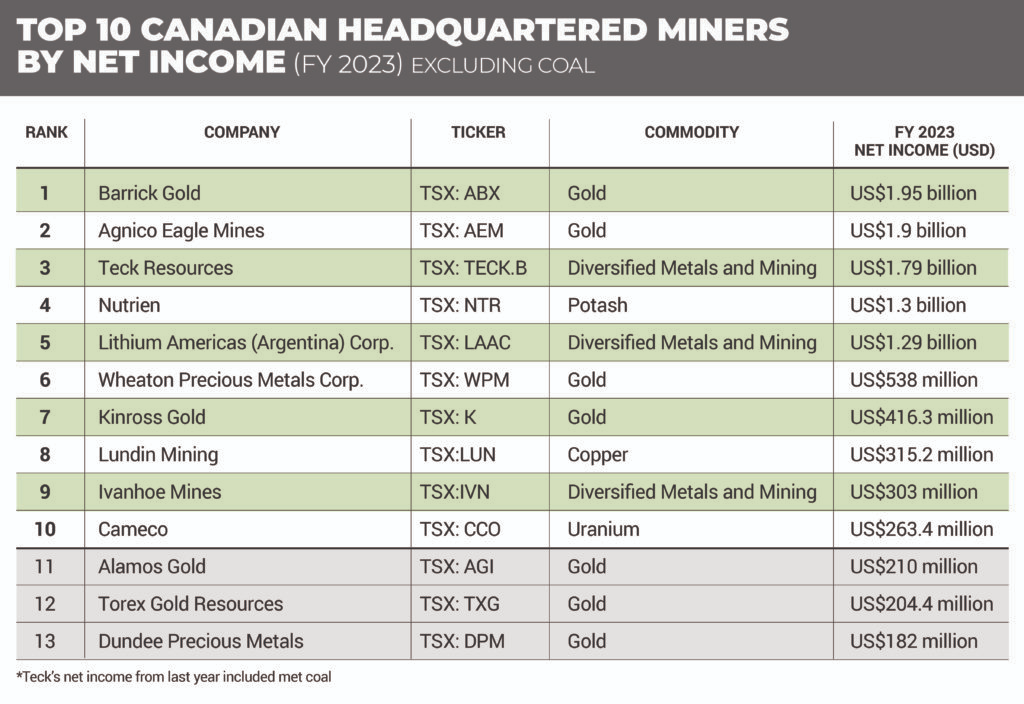

Barrick Gold (TSX: ABX; NYSE: GOLD) leads our list of Canadian miners by net income at $1.95 billion and is second according to market value at C$44.7 billion.

The company produced 1.9 million oz. gold and 83,000 tonnes of copper in this year’s first half, the company said in July. That compares with 1.1 million oz. gold and 102,058 tonnes copper in last year’s second half, according to its annual report.

Barrick says costs should decline as output increases during this year’s second half. The global miner, which has only the Hemlo mine in Canada, expects increased production at Turquoise Ridge in Nevada after maintenance at the Sage autoclave in the first quarter. It continues to ramp up output at Porgera in Papua New Guinea and posted increases at Tongon in Ivory Coast, North Mara in Tanzania and Kibali in the Democratic Republic of Congo (DRC).

Those increases were partially offset by planned lower production at Cortez and Phoenix in Nevada. Pueblo Viejo production in the Dominican Republic was flat as the miner plans to increase throughput and recovery rates in the year’s second half, it said.

Mali junta

Barrick is also contending with the junta in Mali that wants more taxes from the Loulo-Gounkoto operation that produced 683,000 oz. of gold last year. Rights groups say the mine is funding Russia because its Wagner Group mercenaries are backing the military government.

“Barrick has been engaging with the National Directorate of Geology and Mines to grow our exploration footprint here, securing our ability to deliver real value to Mali,” CEO Mark Bristow said in July in rare comments since the junta took power a year ago. “We continue to work constructively towards a global resolution of our differences.”

Bristow has a history of working with governments in troubled areas as it develops the $7 billion Reko Diq project in Pakistan after reopening Porgera, both with deals giving locals about half the profit.

Dealmaker

Wheaton Precious Metals (TSX: WPM) is number three in market capitalization at C$37.9 billion and sixth in net income at $538 million. Its streaming and royalties model reduces exposure to operational risks for its own shareholders while offering alternative capital raising for companies that may be thwarted by stock market valuations.

From August last year, the company notched up eight deals valued at more than C$1 billion in potential payments, according to president and CEO Randy Smallwood. He’s targeting 850,000 gold-equivalent oz. of annual production.

Nutrien (TSX: NTR; NYSE: NTR), the world’s largest potash producer, clocks in at number four on both lists, with a market value of C$34.5 billion and net income last year of $1.29 billion. The company said in July it’s reviewing strategic options for its half ownership of Argentine fertilizer company Profertil and said it’s no longer pursuing the $2 billion Geismar clean ammonia project in Louisiana.

Teck Resources (TSX: TECK.B), is sixth on our list of market values at C$32.6 billion after it sold three-quarters of its Elk Valley coal assets to Glencore (LSE: GLEN) and the rest to Nippon Steel of Japan and POSCO of South Korea. Formerly Canada’s largest diversified miner, the company is now focused on copper.

Future growth

Teck doesn’t make our top 13 in net profit for last year, but BMO Capital Markets is upbeat about the company’s future. Teck will be a cleaner investment story as a simplified copper investment vehicle, mining analyst Jackie Przybylowski wrote in a July 15 note.

“Completion of this transaction refocuses Teck as a Canadian-based critical minerals champion,” she said. “The proceeds from the coal sale will fund future growth — either from Teck’s existing portfolio of copper growth options or through acquisition of new assets.”

Cameco (TSX: CCO; NYSE: CCJ) ranked seventh with C$22.7 billion in market value and 10th in net income with $263 million as it rode a uranium price surge that peaked in January at $106 per lb., the highest in 17 years. Lower-than-expected sales hurt first-quarter results, but the company said it expects metal revenue to rebound and its 49%-owned Westinghouse nuclear plant services division to have a stronger second half.

DRC

Ivanhoe Mines (TSX: IVN) in the DRC in July restarted the century-old Kipushi mine which aims to be the world’s fourth-largest zinc producer. The company founded by co-chair Robert Friedland is eighth on the market cap list at C$24.8 billion, and ninth in net income at $303 million.

Also in Congo, the Kamoa-Kakula complex, which holds the world’s fourth-largest copper resource, produced 186,925 tonnes of the wiring and plumbing metal in this year’s first half. It’s ramping up its stage three concentrator capacity this quarter to more than 600,000 tonnes a year. Ivanhoe owns 39.5% of Kamoa-Kakula, which aims to produce 440,000 to 490,000 tonnes of copper in concentrate this year.

The company benefits from United States funding of a rail line across Angola to the Atlantic from the Zambia-DRC copper belt. The company, metals trader Trafigura and Angola are considering a 2,000-megawatt high-voltage line from northern Angola hydro-electric plants to the copper region.