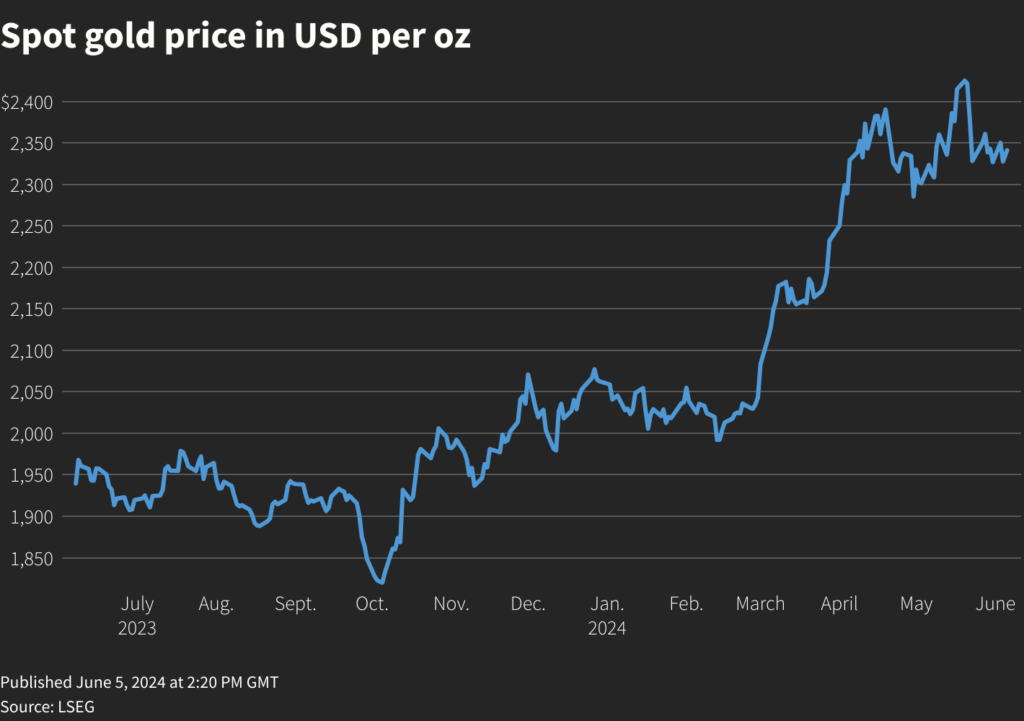

Safe-haven demand driven by geopolitical and economic uncertainty as well as persistent central bank buying contributed to a rally in gold from March to May, taking spot prices to a record $2,449.89 per ounce on May 20.

“Although there are downside risks in the near term, we are confident that prices will see a new record before the end of the year and average $2,250 for the full year, marking another annual average record,” Metals Focus said.

Sentiment towards gold is supported by fears over US government debt, the anticipated arrival of rate cuts, elevated geopolitical tensions and economic uncertainties, it said.

From the point of view of fundamentals, demand from central banks remains significantly higher than pre-2022 when they sped up purchases to diversify foreign currency reserves, providing further support to the price.

“Near-term (price) corrections are likely, as tactical players take profits or are perhaps triggered by liquidations in equities,” Metals Focus said.

“The downside however should be limited, as there are still investors sitting on the sidelines waiting for opportunities to enter the market.”

Meanwhile gold supply, according to the consultancy, will likely rise by 3% to 5,083 tons this year, with mine production and recycling both higher.

Following are Metals Focus’s gold supply and demand numbers, in metric tons:

(Reporting by Polina Devitt; Editing by Jan Harvey)