At the half-year mark, it appears that our prediction was bang-on.

While gold and silver prices were down on Monday, July 8, the outlook for precious metals is good, as for industrial metals including copper due to impending Fed interest rate cuts, at least one by year’s end.

The yellow metal reached $2,393/oz on Friday following the release of US NonFarm Payrolls Data. The weaker labor market and rising unemployment rate, which hit 4.1% in June, is fodder for the US Federal Reserve to slash interest rates, possibly once in September and a second time in December.

“We now have definitive evidence of labour market cooling with a somewhat alarming rise in the unemployment rate in recent months that should give policymakers ‘more confidence’ that consumer inflation will soon return to the 2.0 per cent target on a sustainable basis,” said Scott Anderson, chief US economist at BMO Capital Markets, via The Globe and Mail.

In remarks to Congress, Fed Chair Jerome Powell said the US is “no longer an overheated economy” with a job market that has “cooled considerably” and is back where it was before the pandemic, suggesting the potential for rate cuts is becoming stronger. (Reuters, July 9, 2024)

Powell told senators that inflation has been improving in recent months. The chart below shows the annual inflation rate slowed to 3.3% in May, compared to 3.4% in April and 3.5% in March.

US inflation (CPI). Source: Trading Economics

What’s driving commodities?

Some say that commodities are hedges against inflation and that people buy them when inflation is high. While there is some truth to that, it doesn’t explain why the dollar is surging at the same time as several commodities including gold, silver, copper, zinc, aluminum, molybdenum and crude oil are all rising in price. As for inflation? It’s actually been falling, as the chart above proves.

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

I believe the more likely reason has to do with interest rates. We have proven in several articles that interest rates control strength or weakness in the dollar.

Why the dollar is rising as treasury yields fall

Generally, the dollar and US bond yields rise and fall together, signaling a positive correlation between the two. Conversely, the price of a bond and its yield are negatively correlated. The lower the price, the higher its yield. A rising yield favors dollar bulls. Falling bond yields make for a softer dollar. These are commonly accepted economic principles.

Demand for dollars has been strong, reflected in a US dollar index (DXY) over 105. DXY started 2024 at 102.49, and it is now at 105.15, a gain of 2.5%. This is partly due to the dollar functioning as a safe haven during war — the conflicts in Gaza and the Ukraine have raged all year and show no sign of ending — along with interest rates at their highest levels in 22 years, @ 5.25 to 5.50%.

US dollar index DXY. Source: CNBC

US dollar index DXY. Source: CNBC

Consider: if inflation starts heading back up, and the Fed goes back to hiking interest rates, a higher dollar will sink commodity prices. In other words, the dollar is a stronger variable than inflation when it comes to predicting whether commodities rise or fall.

Investors should, however, buy commodities as protection against a falling currency. When the dollar is weak we buy “real” things like metals, oil, land, etc. If you know the dollar’s going to weaken the best place to park your money is in monetary metals like gold and silver. Other commodities also do well in a low-dollar environment because more units of a commodity can be bought with dollars, and those with non-dollar currencies can buy more dollars with their home currencies. They use these dollars to buy commodities priced in US dollars.

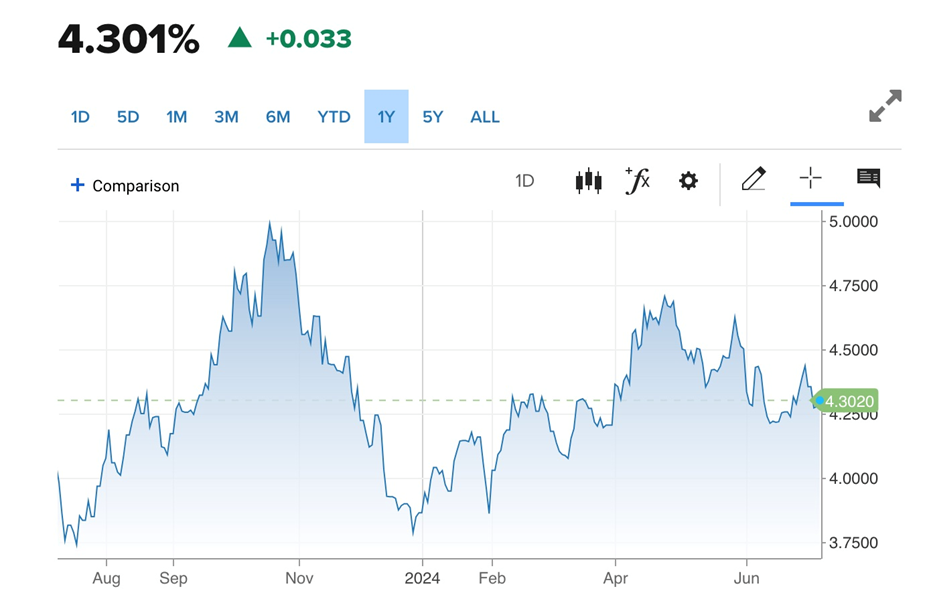

Bond investors are attracted to US Treasuries not only because they are a safe haven but because they pay a relatively high yield right now — 4.30% for the 10-year, 4.62% for the 2-year and 4.49% for the 30-year.

US Treasury 10-year yield. Source: CNBC

US Treasury 10-year yield. Source: CNBC

The purchase of more commodities in a low-dollar environment exacerbates shortages in markets showing low supplies. All three metals being discussed here — gold, silver and copper — are either undersupplied now or will be in the near future.

The dollar hasn’t dropped yet. But those in the know (including us at AOTH) believe it will. A Goldman Sachs note to clients Monday said hedge funds bought commodity-sensitive stocks in the week to July 5 at the fastest pace in five months. (BOE Report, July 8, 2024)

If commodity prices are doing well now, while the dollar is high, how much higher could they go when interest rates and the dollar fall?

Gold

The specter of lower interest rates is a bullish signal for gold. FX Street commented on Monday that gold continues to gain support from geopolitical and macro factors, such as ongoing conflicts in the Middle East and Ukraine.

Egon von Greyerz, chairman of Gold Switzerland, points out that the political instability inherent in current and future elections this year is another good reason for owning precious metals. Especially given that out-of-control government spending is likely to be the predominant policy response. Examples are the new Labour government in Britain, France’s new coalition government, and “an insoluble debt crisis” in the US no matter which presidential candidate wins in November.

Meanwhile, de-dollarization by countries at odds with the United States, who fear that the US could freeze their dollar assets like Washington did to Russia following the invasion of Ukraine, is increasing the appeal of gold as a foreign-exchange alternative.

BRICS nations, now wealthier than the G7 and accounting for one-third of the world’s GDP, are reportedly discussing the launch of a BRICS cryptocurrency potentially backed by gold.

A recent report from the World Gold Council sees climate change as another source of safe-haven gold demand:

Gold’s carbon profile and decarbonisation potential may reinforce or amplify gold’s role as a safe haven asset, risk hedge and store of value during periods of market stress.

“This lends further credence to our analysis suggesting that gold’s long-term returns may be more robust than those of many mainstream asset classes in the context of a range of climate scenarios.”

Although a recent analysis finds gold only becomes an inflation hedge over long periods of time; 10 years is too short.

In a paper, Prof. Campbell Harvey of Duke University and co-author Claude Erb write that, for investors who add gold in their portfolio today, with high inflation and gold prices close to an all-time high, the expectation that gold will keep its real value in the next 10 years is not consistent with history.

“When gold is at an all-time high, the expected returns over the next 10 years — according to historical experience — is very low,” Harvey said.

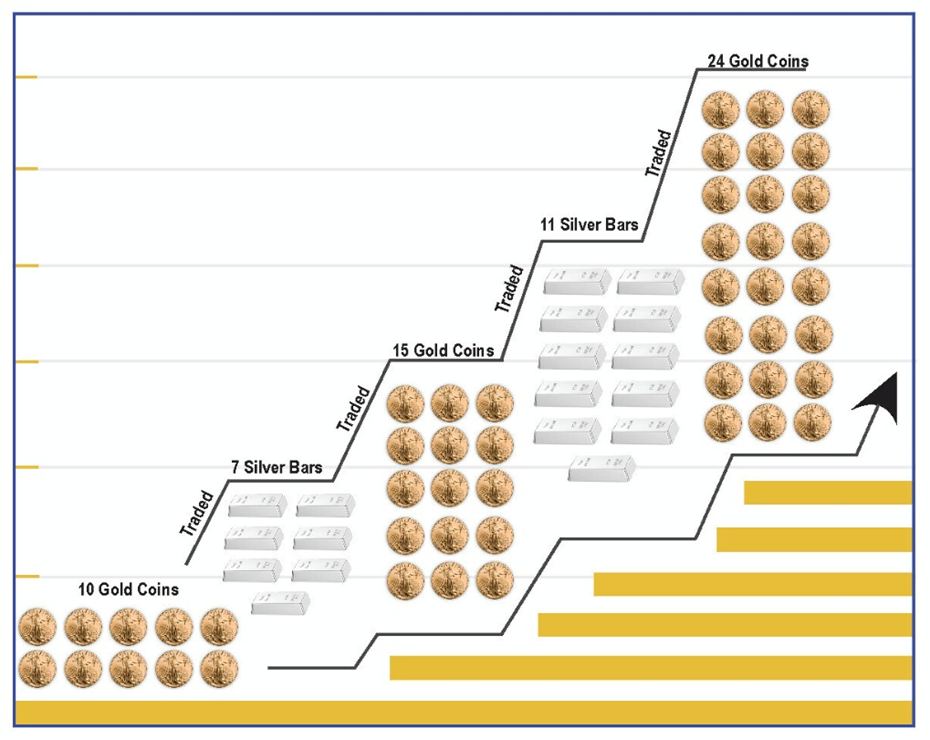

As evidence of gold acting as a longer-term hedge, Campbell and Harvey offer the example of a Roman centurion who was paid 38.58 ounces of gold two millennia ago.

“At today’s price of gold, it would be $86,300, which is very close to the salary of a U.S. Army captain with six years of experience — $85,600,” Harvey said.

High central bank demand, which accounts for about a quarter of the gold market, is an additional factor in favor of gold.

In its annual survey, the World Gold Council said more central banks plan to add to their gold reserves within a year, despite high prices. Gold hit a record-high $2,449.89 per ounce on May 20. The survey said 29% of central banks expect their gold reserves to increase in the next 12 months, the highest level since the WGC began the survey in 2018, and compared with 24% in 2023.

Livemint says relentless demand from retail buyers in China and India, — the two largest physical gold consumers — along with fund investors, futures traders and central banks, drove gold to unprecedented heights.

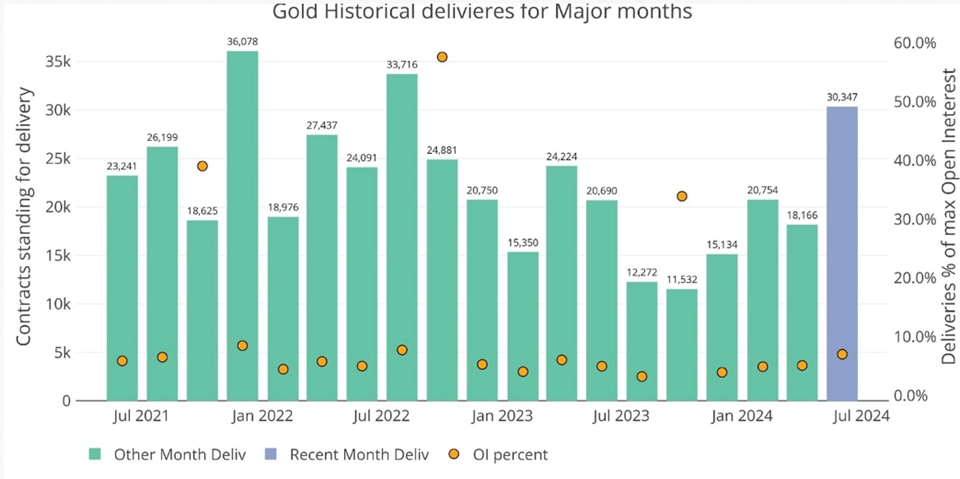

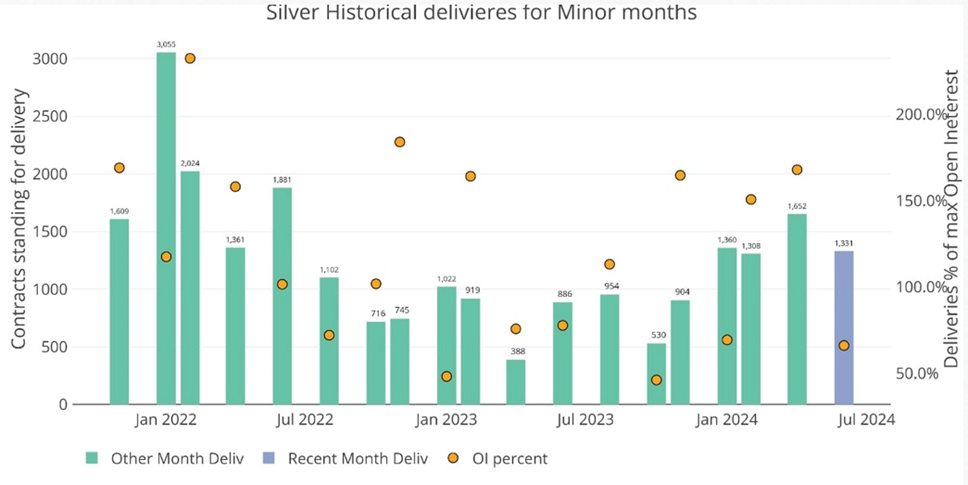

Meanwhile the CME Comex, an exchange where futures are traded for gold, silver, and other commodities, has been seeing big moves in silver and gold. This means more people are taking delivery of physical metal.

According to Schiff Gold, May showed open interest in gold at well above trend — 30,000 contracts stood for delivery in June, the largest volume since August 2022.

Activity in silver has also picked up after a quiet 2023.

Source: Schiff Gold

Source: Schiff Gold

Source: Schiff Gold

Source: Schiff Gold

As for gold exchange-traded funds, a major source of gold investment demand, outflows have flipped to inflows. Globally, gold ETFs saw the second consecutive month of inflows in June due to additions to holdings by Europe- and Asia-listed funds, the World Gold Council (WGC) said on Tuesday, via Reuters. (although collective holdings remain at their lowest since 2020)

Finally, gold prices are pushing higher due to a shortfall of mined gold.

In a world of resource depletion, it falls to gold exploration companies to fill the gap with new deposits that can deliver the kind of production required to meet gold demand, which is currently out-running supply.

The gold market continues to experience tightness due to difficulties expanding existing deposits, and a pronounced lack of large discoveries in recent years.

In 2023, 4,448 tonnes of gold demand minus 3,644t of gold mine production left a deficit of 804t. Only by recycling 1,237t of gold jewelry could the demand be met. (The World Gold Council: ‘Gold Demand Trends Full Year 2023’)

This is our definition of peak gold. Will the gold mining industry be able to produce, or discover, enough gold, so that it’s able to meet demand without having to recycle jewelry? If the numbers reflect that, peak gold would be debunked. We’ve been tracking it since 2019, and it hasn’t happened yet.

Silver

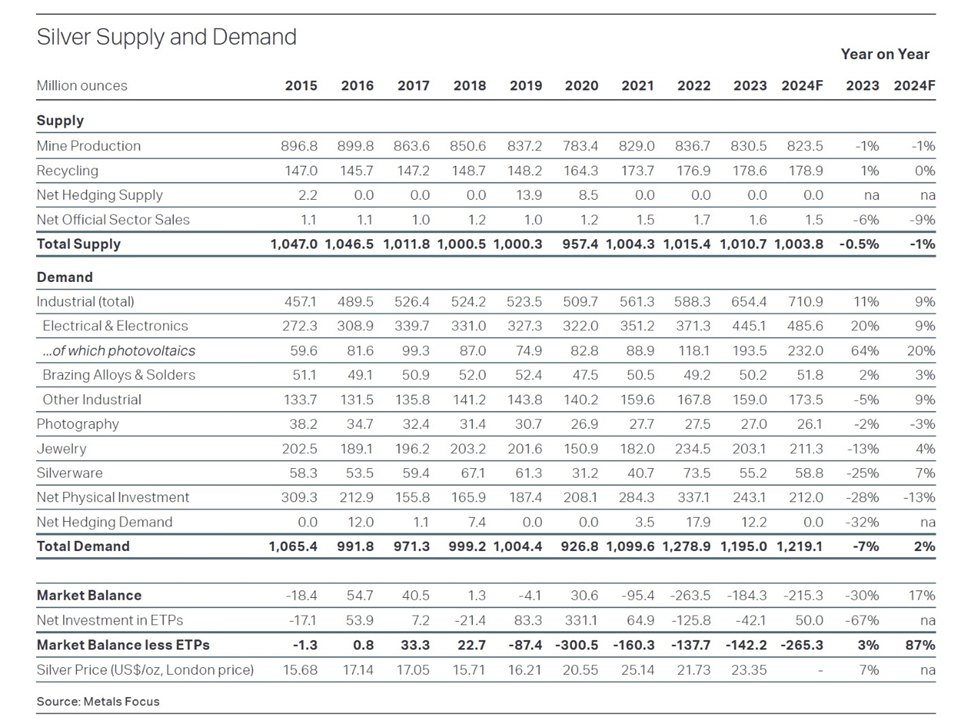

Like gold, we can study the supply-demand picture for silver to get a sense of whether we’ve reached peak mine supply.

At AOTH we differentiate between the total silver supply, which lumps in recycled silver with mined silver, versus mine supply on its own.

According to the 2024 Silver Survey, in 2023 global mine production fell 1% to 830.5 million ounces, or 25,830 tonnes. Weaker output in Mexico owing to a strike at Newmont’s Penasquito mine and lower ore grades in Argentina were key drivers of the fall.

Silver recycling inched up by 1% to a 10-year high of 178.6Moz. Combined, therefore, we have total silver supply reaching 1.010 billion ounces in 2023.

How about demand? According to the survey, following a record 2022, world silver demand in 2023 fell 7% to 1.195Moz. It was still 9% higher than the next highest yearly total. Offtake from the industrial sector achieved a record high last year, rising 11% to 654.4Moz, mainly due to gains in the solar sector.

(Remember: While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing. Of the 60% used for industrial applications, almost 80% ends up in landfills.)

2023 demand of 1.195 billion ounces outstripped supply of 1.010Boz, by 185Moz. But remember, recycling is included in the total supply. When we take recycling out, 178Moz, we get an even greater deficit of 364.5Moz. (1,195,000,000 minus 830,500,000 = 364,500,000)

This is significant, because it’s saying that mined silver supply last year was unable to meet total demand, industrial plus investment, of 1.195 billion ounces. It fell short by 185Moz, and that was including recycling.

This is our definition of peak mined silver. Will the silver mining industry be able to produce, or discover, enough silver that it’s able to meet demand without having to recycle? If the numbers reflect that, peak mined silver would be debunked.

At AOTH, we know that silver prices track gold prices, and that there is approximately the same amount of investable grade silver above-ground as gold. Yet silver is currently 1/76th the price of gold. This means that when silver is highly demanded, like now — it is both a monetary and an industrial metal — the price often slingshots past gold.

How many ounces of silver does it cost to buy an ounce of gold?

How many ounces of silver does it cost to buy an ounce of gold?

Source: McAlvany

So far this year, silver has outperformed gold, gaining 33% against gold’s 15% rise. The same thing happened in 2020, when the pandemic precipitated the “fear trade” in precious metals.

Gold is moving higher primarily due to central bank buying, and physical gold purchases in Asia.

Who’s buying all the silver? India and silver-backed ETFs.

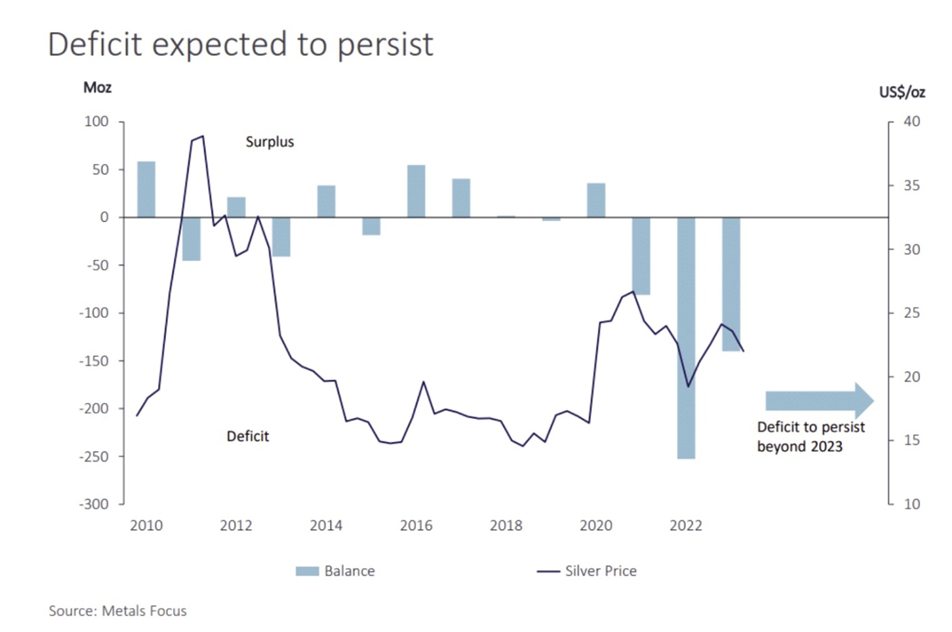

The Silver Institute reported a 184.3 million-ounce deficit in 2023 on the back of robust industrial demand.

In an April commentary, SI said industrial demand rose 11% last year to a new record of 654.4Moz, smashing the old record set in 2022.

In fact demand exceeded supply for the third year in a row.

Higher-than-expected photovoltaic (PV) capacity additions and faster adoption of new-generation solar cells raised electrical & electronics demand by a substantial 20%, to 445.1Moz, the institute said.

The Silver Institute expects demand to grow by 2% this year, led by an anticipated 20% gain in the PV market. Industrial fabrication should post another all-time high, rising by 9%. Demand for jewelry and silverware fabrication are predicted to rise by 4% and 7%, respectively.

Total silver supply should decrease by another 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

Deficits should persist beyond 2024, the Silver Institute said, citing Metals Focus. According to Metals Focus, this is due to significant and expanding industrial demand for silver.

Copper

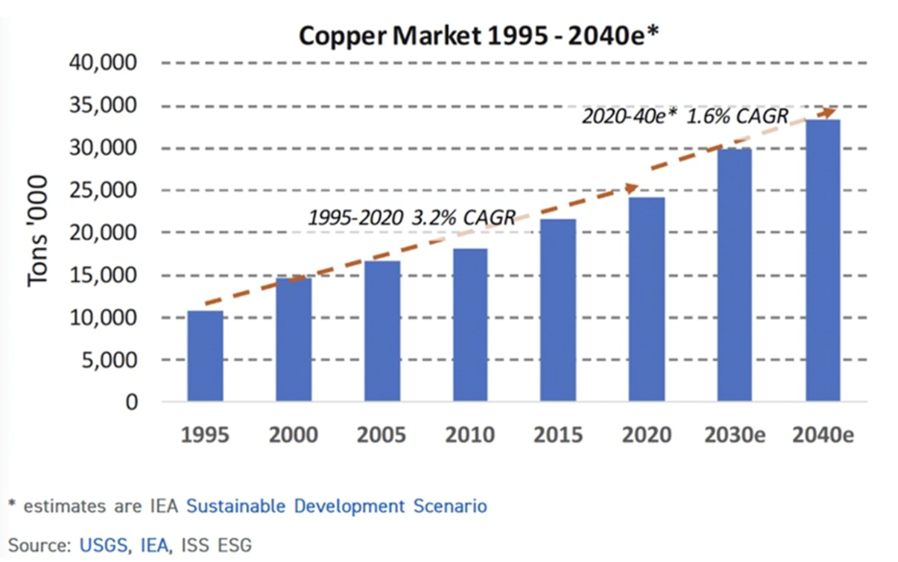

Copper may have come off the boil recently due to problems in China but the structural supply deficit is real and keeping prices elevated.

Benchmark Mineral Intelligence (BMI) forecasts global copper consumption to grow 3.5% to 28 million tonnes in 2024, and for demand to increase from 27 million tonnes in 2023 to 38 million tonnes in 2032, averaging 3.9% yearly growth.

Yet the US Geological Survey reports supply from copper mines in 2023 amounted to only 22 million tonnes. If the copper supply doesn’t grow this year, we are looking at a 6Mt deficit.

Mining companies are seeing their reserves dwindle as they run out of ore. Commodities investment firm Goehring & Rozencwajg says the industry is “approaching the lower limits of cut-off grades and brownfield expansions are no longer a viable solution. If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all.”

Without new capital investments, Commodities Research Unit (CRU) predicts global copper mine production will drop to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Last year, the government of Panama ordered First Quantum Minerals (TSX:FM) to shut down its Cobre Panama operation, removing nearly 350,000 tonnes from global supply.

A strike at another large copper mine, Las Bambas in Peru, temporarily halted shipments.

Copper specialist Anglo American says it is scaling back output by about 200,000 tons, owing to head grade declines and logistical issues at its Los Bronces mine. Los Bronces production is expected to fall by nearly a third from average historical levels next year as the miner pauses a processing plant for maintenance, Reuters said.

Chile’s copper output has been dented by a long-running drought in the country’s arid north. State miner Codelco’s 2023 production was the lowest in 25 years.

All four of Codelco’s megaprojects have been delayed by years, faced cost overruns totaling billions, and suffered accidents and operational problems while failing to deliver the promised boost in production, according to the company’s own projections.

There are also concerns about Zambia, Africa’s second largest copper producer, where drought conditions have lowered dam levels, creating a power crisis that threatens the country’s planned copper expansion.

Ivanhoe Mines (TSX:IVN) reported a 6.5% Q1 drop in production at the world’s newest major copper mine, Kamoa-Kakula in the DRC.

The tightness of the copper concentrate market has been reflected in treatment and refining charges plummeting from over $90 per tonne to below $10/t.

(Miners pay smelters a fee to process copper concentrate into refined metal, to offset the cost of the ore. TC/RCs fall when tight concentrate supplies squeeze smelters’ profit margins.)

This drastic reduction compelled Chinese smelters, responsible for around half of global refined copper production, to consider a 5-10% production cut.

That was in March. By July, the situation had flipped 180 degrees. Now China is apparently swimming in copper, so much so that it is exporting refined copper to London Metal Exchange warehouses, which are full to the brim. LME warehouse stocks are reportedly above 190,000 tonnes for the first time since last October.

The Financial Times wrote on June 18 that The biggest glut of copper in four years has built up in Chinese warehouses, after a price jump and tepid consumer demand prompted manufacturers in Asia’s largest economy to pull back on buying the world’s most important industrial metal. Stocks of the metal in Shanghai Futures Exchange warehouses have grown to their highest level since 2020 at about 330,000 tonnes this month, according to Bloomberg data. Before then, the last time they hit this level was in 2015.

The rise in copper inventories reflects China’s real estate downturn as well as sluggish manufacturing and credit activity, as Beijing shies away from directly stimulating household consumption. In the four weeks since the record high, copper has fallen 13 per cent to $9,600 per tonne, weighed down by weak Chinese demand.

Yet as warehouse stocks build up in China and the UK, the country is importing large amounts of red metal. Reuters metals columnist Andy Home wrote on July 10 that China imported 1.61 million tons of refined copper in the first five months of the year, a year-on-year increase of 19.2%.

The comparison is somewhat flattered by a low base in early 2023, when imports were relatively weak. But imports over the last 12 months have been a robust 3.98 million tons, a level exceeded only once on an annual basis in 2020.

Exports jumped to 73,860 tons in May, the highest monthly volume since May 2016, as smelters exported into a profitable arbitrage window with the London market…

The core driver of rising imports has been the Democratic Republic of Congo, which last year overtook Chile as China’s top supplier of refined copper.

Imports from the Congo grew from 480,000 tons in 2020 to 870,000 in 2023. Volumes so far this year have jumped by another 78% to 548,000 tons.

China is the world’s largest copper consumer so China’s actions in the market are watched closely because they affect the price.

To ensure self-sufficiency, China has expanded its network of copper smelters, meaning it will import much more copper ore for processing domestically.

“Like all countries, China sees a strategic need for copper — particularly now with the growth in green energy applications — and China like other countries wants to ensure self sufficiency,” said Craig Lang, principal analyst at researcher CRU Group.

“China will account for about 45% of global refined copper output this year, according to CRU,” Bloomberg wrote in 2023.

Let’s summarize what’s going on here. China is expanding its smelter capacity. To do this, it requires more ore and it is getting it mostly from the DRC, which has overtaken Peru as the second-largest copper-producing country. Imports are surging at the same time as warehouses are filling up.

China has tricked the market before into believing there is a surplus when in fact there is a deficit. I exposed this “Copper Con” in March 2015. Here’s what happened:

China found every analyst they could and invited them to China. The group was shown a few warehouses stacked with copper to the rooftops. There was so much copper the ground was compacting, said one analyst. Another said the stacks were falling over like dominos. The world bought the surplus story, swallowed it hook line and sinker. Headlines screamed ‘China has enough copper!’

Of course it wasn’t true. China needed copper, and what they had, all of 2 million tonnes, was tied up in financing deals. At any one time there are at least 1 million tonnes in transport, or somewhere in the supply chain that has already spoken for, i.e.., not available.

Exposing the copper surplus myth

The world continues to get conned. Every year so-called “experts” predict a surplus; instead what happens? Deficit after supply deficit.

It makes sense that China would try to manipulate the market not long after copper hit a record high. China wants to pay lower prices for its copper and has created an artificial surplus by filling up its Shanghai warehouses and exporting refined copper to LME warehouses. The tactic worked. Spot copper is down 14.7% since its May 20 pinnacle.

On the demand side, along with the usual applications in construction wiring and plumbing, transportation, power transmission and communications, there is now added demand for copper in electric vehicles and renewable energy systems.

Millions of feet of copper wiring will be required for strengthening the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms. Electric vehicles use triple the amount of copper as gasoline-powered cars. There is more than 180 kg of copper in the average home.

Additional copper is being demanded by the electrification of public transportation systems, 5G and AI.

According to Nikkei Asia, prices are being buoyed by the need for more data centers to support the development of artificial intelligence, all of which will require copper.

The latest copper demand driver comes from the Ukraine, where the war with Russia is consuming tonnes of bullet cartridge casing made of brass, an alloy of copper and zinc.

The European Defense Agency says a NATO 155-mm artillery shell contains half a kilogram of copper, with Ukrainian forces firing up to 7,000 per day.

Citigroup is bullish on copper going forward, with the bank’s analysts predicting that prices could surpass $10,000 a tonne ($4.53/lb) this year due to policy support in China. (the incentive price to build new mines is $11,000/t)

Mining.com reports Beijing is expected to introduce further stimulus to upgrade its renewable energy infrastructure at the Third Plenum meeting in mid-July:

These additional measures, specifically targeting domestic property and grid investments, are expected to support copper prices in the near term, Citi analysts said in a note.

Investing in the trend

Historically, junior resource stocks offer the best leverage to a rising commodity price because of the huge opportunity for gains.

The most upside comes from a junior in the exploration stage when they make an initial discovery. Great drill assay results can send a junior’s share price skyrocketing. The reverse can also be true. Junior explorers working “greenfield” properties (no mining has ever taken place) are the riskiest plays. Strike out on assay results and it could be goodbye to a share price rise for a long time – until the company finds another project.

Next is the post-discovery resource definition stage. These companies have already found something, the share price has settled back after the initial discovery, and the junior is drilling and likely doing other exploration work, like sampling and surveying, to try and prove up a maiden resource.

The third company stage is the asset/ development stage. Here the advanced-stage junior has already managed to put together a resource, which could be measured and indicated (more certainty, less risk) or inferred (less certainty, more risk). They believe the deposit is large and rich enough to start down a development path. An asset/development stage company is, in the opinion of management, and likely stockholders who are following the story, likely to become a mine.

When assembling a portfolio of junior resource stocks, it’s always a good idea to have a few stocks in each of the three company stages. A pure exploration play may sometimes feel like chasing a rainbow but the possibility of making 5, 10, even 20 times your money by purchasing a penny stock that goes ballistic on a discovery hole is reason enough for us to risk part of our investment capital.

I always aim to have a few post-discovery resource definition stage juniors in my portfolio, too. The risk has been greatly reduced, the wait time for a discovery non-existent, and the reward can be very nice, considering the much lower amount of risk, compared to an exploration-stage junior.

At AOTH, we don’t generally invest in major or mid-tier mining companies because smaller companies offer far greater upside, but investors may wish to include a few producers in their portfolio. You want to choose a miner that offers you direct exposure to the commodity you’re interested in.

A good example is Freeport McMoRan (NYSE:FCX). Headquartered in Phoenix, Arizona, Freeport operates large, enduring, geographically diverse assets with significant proven and probable reserves, and primarily explores for copper, gold, molybdenum, silver and cobalt.

The company is the world’s largest publicly traded copper producer and the fifth largest miner by market cap.

FCX’s portfolio of assets includes the Morenci mine in Arizona, Cerro Verde in Peru, El Abra in Chile, and the massive Grasberg mine in Indonesia. For more details click on the Operations tab on Freeport’s website.

The stock is up 22% year to date.

For direct copper exposure I also like Hudbay Minerals (TSX:HBM). Hudbay recently acquired Copper Mountain Mining and 75% of its Copper Mountain mine in south-central British Columbia (the remainder is owned by Mitsubishi Corp), making it the third-largest copper producer in Canada.

Hudbay is also active in Manitoba’s Flin Flon Snow Lake Greenstone Belt. The company says its Lalor mine (gold, zinc, copper, silver) in Snow Lake is a meaningful low-cost gold producer that substantially benefited from the refurbishment of the New Britannia mill in 2021. Hudbay has been drill-testing the down-plunge gold and copper extensions of the Lalor deposit, in the first step-out drilling in the deeper zones at Lalor since the initial discovery of the gold zones in 2009.

Hudbay owns the producing Constancia copper mine in Peru, and is developing the Copper World Complex in Arizona and the Mason project in Nevada.

HBM has soared 73% YTD.

I invest in a lot of precious metal juniors but for direct exposure to silver I like Hecla and Coeur, and for gold I like Agnico Eagle.

Hecla Mining (NYSE:HL) is the oldest silver company on the New York Stock Exchange and the biggest US silver producer. It has been mining since 1891.

Hecla has four producing mines: Greens Creek in Alaska, Lucky Friday in Idaho, Casa Berardi in Quebec, and Keno Hill in the Yukon.

The company is also exploring for silver in three countries. Its US development properties are San Juan Silver in Colorado, Silver Valley/Star in Idaho, Republic in Washington State, Rock Creek and Libby in Montana, and five projects in Nevada.

In Canada, Hecla has the Kinskuch property in British Columbia, Heva-Hosco and Opinaca/Wildcat in Quebec, and Rackla in the Yukon.

Its Mexico focus is the San Sebastian silver-gold project in Durango State.

Hecla is up 16% YTD, having reached a 52-week high of $6.23 on May 20. It retraced to $4.77 on July 1 but is now trading at $5.47.

Coeur Mining (NYSE:CDE) is a US-based precious metals producer with four operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, and the Wharf gold mine in South Dakota. Also, the company owns the Silvertip polymetallic exploration project in British Columbia.

Coeur’s stock has doubled this year, from $3.20 at the start of the year to the current $6.40.

Agnico Eagle Mines (TSX:AEM) is a Canadian senior gold mining company and the third largest gold miner in the world, producing precious metals from Canada, Australia, Finland and Mexico.

The company owns the two largest gold mines in Canada — Canadian Malartic and Detour Lake. Agnico plans to upgrade Detour Lake, located near the Ontario-Quebec border, into a million-ounce-per-year producer by digging for higher-grade ore beneath the current open pit, and following a gold system that tracks west.

The rest of Agnico Eagle’s impressive production portfolio comprises the Fosterville mine in Australia, the Kittila mine in Finland, the Goldex and LaRonde complexes in Quebec, Macassa in Ontario, the Meadowbank Complex and Meliadine mine in Nunavut, and the La India and Pinos Altos mines in Mexico.

AEM started the year at $72.05 and now trades at $99.63, for a substantial gain of 38%.

Two of my favorite copper juniors are Kodiak Copper and Max Resource. I also like Max for silver, due to the massive sedimentary copper-silver property it is developing in Colombia.

Silver North Resources is the other Ahead of the Herd silver play. For gold I like EGR Resources and Storm Exploration.

Kodiak Copper’s (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) MPD property is surrounded by several producing and past-producing mines. The producers are Copper Mountain to the south, Highland Valley in the north, and New Afton, close to Kamloops, re-opened by New Gold in 2012.

The project lies within the southern portion of the Quesnel Terrane, British Columbia’s main copper-producing belt.

Historical drilling saw 384 holes completed since the 1960s by previous operators. Most of the drills tested mineralization from surface, with holes rarely testing below 200m depth.

Over the past four years, Kodiak Copper has completed 123 drill holes or 74,804 meters.

The company tasted success during its maiden drill program in 2019 with the discovery of the Gate Zone.

Kodiak Copper is undergoing a 10,000-meter drill program focused on multiple drill-ready targets in the MPD North and South project areas. The goal is to locate high-grade mineralization, expanding the near-surface mineralization around known zones, and making new discoveries.

This year’s field program is unique for Kodiak Copper in that artificial intelligence (AI) is being used to generate and confirm drill targets.

Six target areas are slated for drilling: two at MPD North (Belcarra and Blue) and four at MPD South (1516, South, Adit and Celeste). The targeting strategy involves the integration of targets developed by Kodiak’s exploration team and VRIFY AI’s predictive modeling.

VRIFY has recognized nine areas of interest, either adjacent to known copper-porphyry zones (Gamma, Zeta, Epsilon, Lambda, Omega and Sigma), or as new priority regions (Omicron, Iota and Tau) which merit follow-up.

Kodiak Copper

TSXV:KDK

Cdn$0.49 2024.07.10

Shared Outstanding 63.9m

Market cap Cdn$36.8m

KDK website

Max Resource’s (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) Cesar copper-silver project in Colombia is an enormous, district-scale property on which Max has just cut an 80/20 earn in deal with Freeport McMoRan.

The Cesar project is situated along the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

The Cesar project land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits and includes 20 mining concessions covering over 188 square km.

Max has made significant progress at Cesar, its field teams have so far identified 28 high-priority targets across the three districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

Under the earn-in agreement, announced on May 13, 2024, Arizona-based Freeport has an option to acquire up to 80% of Cesar by spending CAD$50 million to explore the property, and making a series of cash payments totaling CAD$1.55 million.

To earn an initial 51% interest, Freeport is required to fund $20 million of exploration expenditures at Cesar over five years and make staged cash payments to Max totalling $0.8 million. Max remains the operator of Cesar during this initial stage.

Once Freeport earns its initial 51% interest, Freeport can increase its interest to 80% by funding a further $30 million in exploration expenditures at Cesar over five years and making staged cash payments totalling $0.75 million.

Max’s shareholders can look forward to an initial $20 million commitment from FCX for what should soon be the start of a very aggressive exploration/drill program.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.06 2024.07.10

Shares Outstanding 176m

Market cap Cdn$10.5m

MAX website

Silver North Resources (TSXV:SNAG) offers exposure to one of Canada’s most prolific silver districts — Keno Hill.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Between Haldane and its Tim carbonate replacement deposit (CRD), on the BC-Yukon border, Silver North offers strong discovery and development potential against the bullish backdrop for silver.

The Keno Hill Silver District was Canada’s second largest primary silver producer and one of the richest silver-lead-zinc deposits ever mined.

Silver North’s Haldane property is 25 kilometers west of the main Keno Hill deposits, and south of Victoria Gold’s Eagle mine, which poured its first gold in 2019. The 8,164-hectare land package hosts structurally controlled silver veins containing galena, sphalerite, and tetrahedrite-tennantite in quartz-siderite gangue.

In 2021 Silver North announced a new discovery at the West Fault Zone.

The goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m. This was followed by 3.14m of 1,315 g/t silver.

According to Silver North, this new zone has been traced over a 100- by 90-meter area with room to expand along strike and at depth.

Silver North Resources is also working with partner Coeur Mining to develop the Tim property, located on the Yukon side of the Yukon-British Columbia border.

The company earlier this month announced that Coeur has started drilling at Tim. Current plans are to drill approximately 2,000 meters, targeting silver-lead-zinc Carbonate Replacement Deposit (CRD) mineralization similar to that found at Coeur’s Silvertip property 19 km south of Tim.

TSXV:SNAG

Cdn$0.14 2024.07.10

Shares Outstanding 43.3m

Market cap Cdn$6.81m

SNAG website

EGR Exploration (TSXV:EGR) is working near Detour Lake, Ontario, Canada’s second-largest gold operation, within a region hosting several multi-million-ounce deposits.

Located in the northern part of the Abitibi Greenstone Belt, the Detour-Fenelon Gold Trend spans over 200 km of prospective strike length potential along the Sunday Lake and Lower Detour deformation zones. EGR’s property is located 20 km west of the Detour Lake open-pit (hence the name “Detour West”), and also directly adjoins Agnico Eagle’s holdings along the trend.

To maximize its chance of success, EGR since 2020 has increased its landholding and consolidated the entire 40,255-hectare Detour West project area, which is now 35 km long by 15 km wide.

What makes EGR’s ground so intriguing? According to respected geologist Quinton Hennigh, it’s when deformation belts like the Sunday Lake Deformation Zone become constricted, or “squeezed”.

A key task for EGR, as it goes about exploring Detour West, is testing the extension of the SLDZ, trying to prove that Detour West is on trend with Agnico-Eagle’s Detour Lake mine and its 20.7Moz of reserves.

This summer’s drill program envisions at least 35 reverse-circulation (RC) holes, that will target where the gold structures cross onto Detour West, including the “squeezed” deformation zone mentioned by Hennigh.

The drills will puncture an average 40 meters of glacial till before entering the bedrock. “It’s poking multiple shallow holes to find the gold dispersal train and then testing the bedrock to get a sample of what rocks we’re getting into,” CEO Daniel Rodriguez said.

If EGR can show enough gold-in-till from the fenced RC holes it can vector into the source of the mineralization.

EGR Exploration Ltd.

TSXV:EGR

Cdn$0.05, 2024.07.10

Shares Outstanding 40.2m

Market cap Cdn$2.2m

EGR website

Storm Exploration (TSXV:STRM) came to my attention for the exploration agreement it recently signed with the Eabametoong First Nation regarding Miminiska, Keezhik and Attwood, which sit on their traditional territory.

It is unusual for a mining company to prioritize First Nations consultation over other activities, and I think this speaks to the progressive mindset of CEO Bruce Counts and his management team. These days, nothing happens on a mineral exploration property sitting on First Nations land without the nation’s consent.

Storm’s four properties are all are in the vicinity of historic Ontario gold camps, which combined have produced over 200 million ounces. The Fort Hope area is a greenstone belt with the potential to host a major gold camp.

High-grade gold has been confirmed by drilling at a number of locations on the Miminiska property. Historical assays include 5.75g/t Au over 20.84m and 13.95 g/t Au over 5.32m, with mineralization hosted in banded iron formation and associated shear zones.

The Miminiska project bears all the hallmarks of a banded iron formation, which account for around 60% of global iron reserves, The closest analog is Musselwhite, located ~115 km to the northwest. The deposit also has a similar geometry to the Lupin BIF mine, which produced 3.4Moz at 9.1 g/t Au before closure in 2005.

Storm plans to raise money for a drill program at Miminiska.

Ideally, between 2,000 and 2,500 meters would be drilled from six to 10 drill pads. It should be noted that the claims at Miminiska are patented claims, meaning that no drill permits are required. Normal drilling guidelines must still be followed and Storm needs the support of local first nations, which it already has.

Storm Exploration Inc.

TSXV:STRM

Cdn$0.04 2024.07.10

Shared Outstanding 41.6m

Market cap Cdn$2.0m

STRM website

Richard owns shares of Max Resource (TSX.V:MAX).

STRM, KDK, SNAG, EGR and MAXare paid advertisers on his site aheadoftheherd.com

This article is issued on behalf of STRM, KDK, SNAG, EGR and MAX.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.